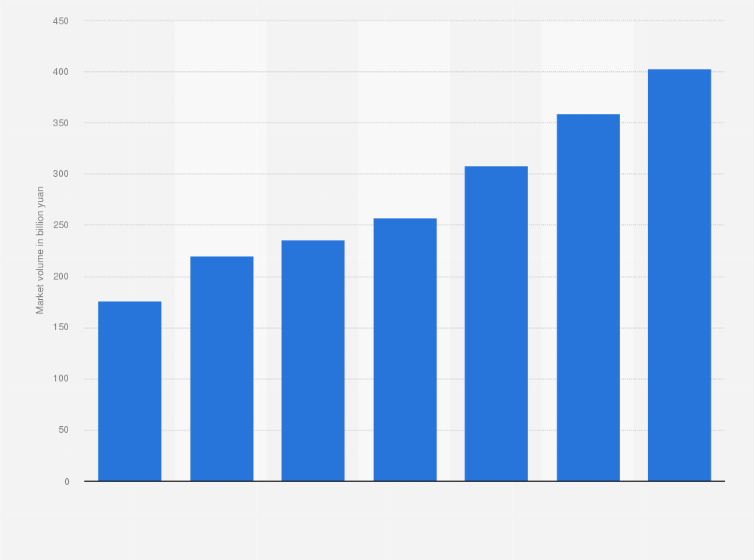

Market scale of the online gaming market in China 2016-2022

Estimated at a value of 403 billion yuan in 2022, China’s online gaming sector has doubled its size within six years. While eSports and a growing female player base appear to be the next big waves of China’s gaming prosperity, the country’s strict regulations could also stunt the growth of these market prospects.