When the New York Fed‘s latest Quarterly Report on Household Debt and Credit revealed that U.S. consumers’ credit card debt had not seen its usual post-holiday-season dip in the first quarter of 2023 all while total consumer debt had risen past $17 trillion for the first time, some reporters rang the alarm bells, saying that Americans were showing signs of financial stress amid high inflation and rising interest rates.

And while it’s true that delinquency transition rates, i.e. the share of current debt becoming delinquent, increased for the fifth consecutive quarter for most types of credit, delinquency rates are still low, historically speaking, with less than 3 percent of total consumer debt delinquent, i.e. at least 30 days late. Moreover, one could argue that the absence of a drop in credit card balances in the first quarter is a sign of robust consumer spending rather than financial stress. After all, credit cards are mostly used as a payment method rather than a borrowing method these days.

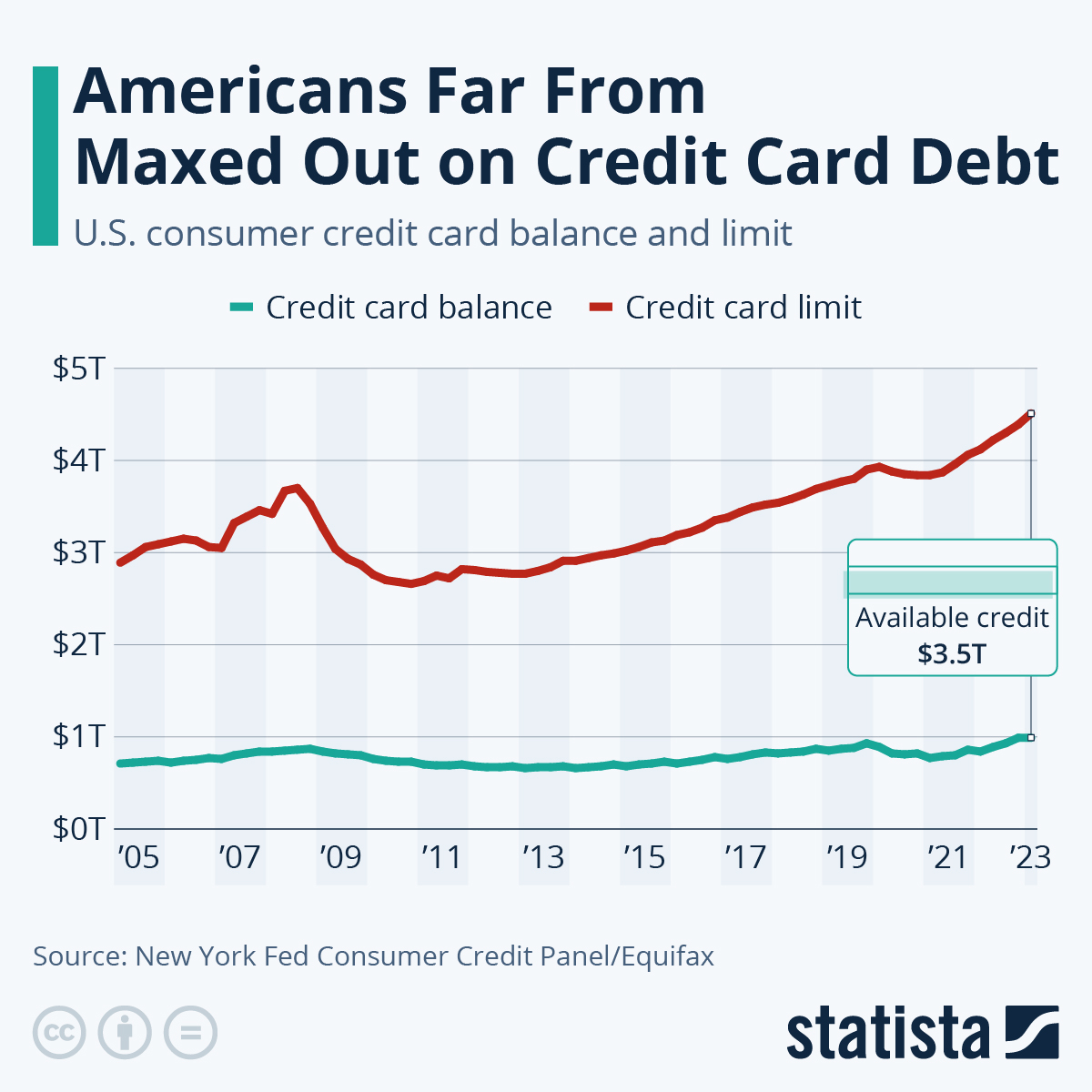

And lastly, as opposed to their government, Americans are far from reaching their debt ceiling, at least as far as credit cards are concerned. With a total credit card balance of $986 billion and a total limit of $4.5 trillion, U.S. consumer actually have $3.5 trillion in untapped available credit on their cards.