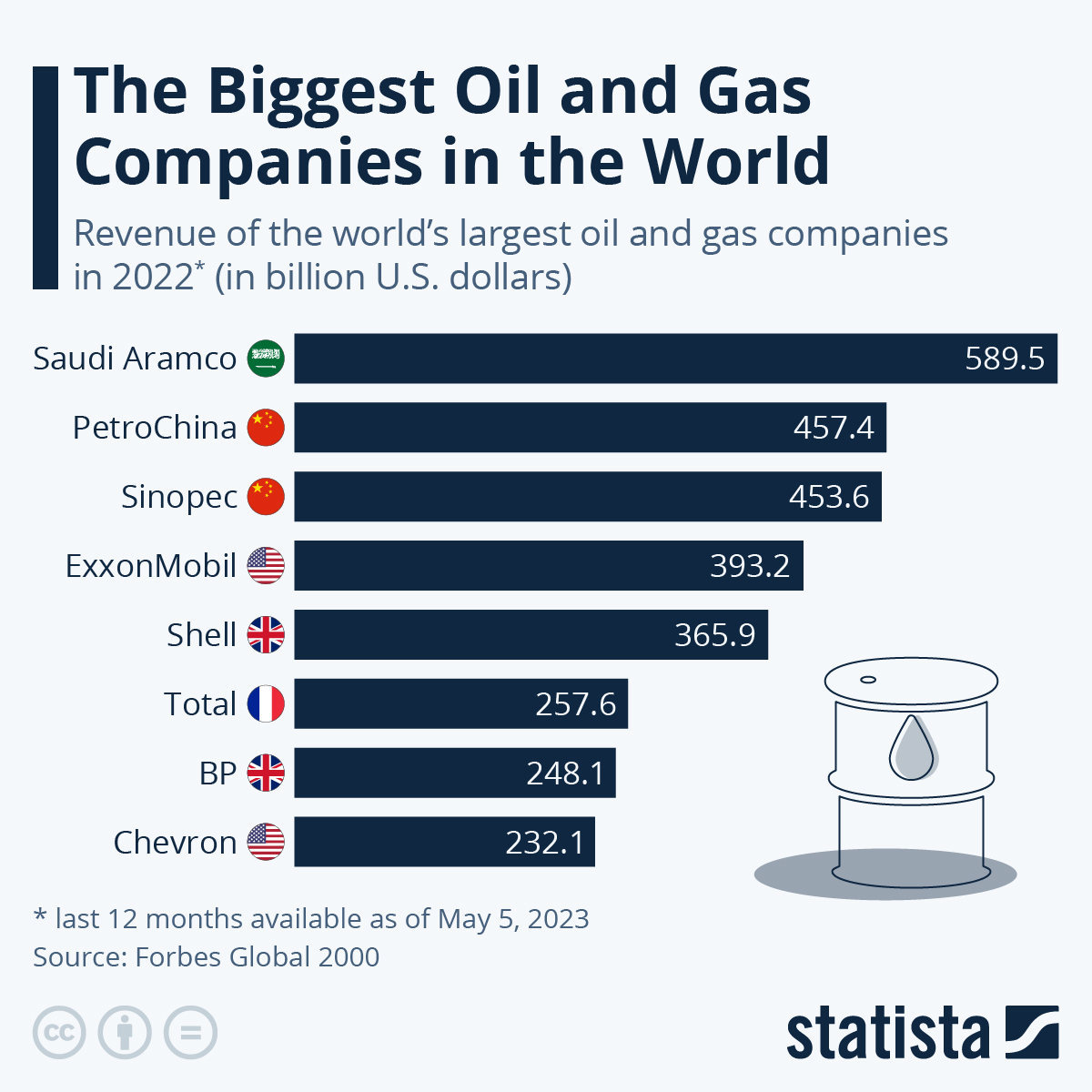

After oil prices skyrocketed following Russia's invasion of Ukraine, eight oil and gas companies brought in revenues of $200 billion or more in 2022, data from the the Forbes Global 2000 shows. Saudi state-owned enterprise Saudi Aramco, which went public in late 2019, is the biggest of them all, followed by PetroChina and Sinopec Group, which had led the list of the world’s biggest oil and gas companies in 2020 as China stayed open for business during the first year of the coronavirus pandemic.

Nevertheless, at revenues of around $450 billion each last year, the two Chinese energy giants earn around 65 percent more now than two years ago. Saudi Aramco even had more than double the revenues in 2022 than it had in 2020. The same is true for the sales of Shell and ExxonMobil, which ranked fourth and fifth, respectively. Russian companies Gazprom and Rosneft, ranked in the top 15 in 2020, weren't listed this year.

While three-digit sales in the billions are not uncommon in the oil and gas industry, revenues in the sector are known to fluctuate majorly in reaction to the price of crude oil on the world market. The favorable conditions in the industry at the moment have also catapulted a couple of lesser known refiners and utility companies above the $100-million revenue mark in 2022.

U.S. refiner Philips 66 made $168 billion last year, while French state-owned utility provider EDF - which sells all sorts of different energy products - made $151 billion. Another refiner, Equinor of Norway, hit $142 billion in sales. Italian companies Eni - from the oil and gas business - and Enel - a utility provider - both made $132 billion each. Also above revenues of $100 billion are state-owned Petrobras from Brazil, utility providers E.on from Germany and petro-conglomerate Eneos from Japan.