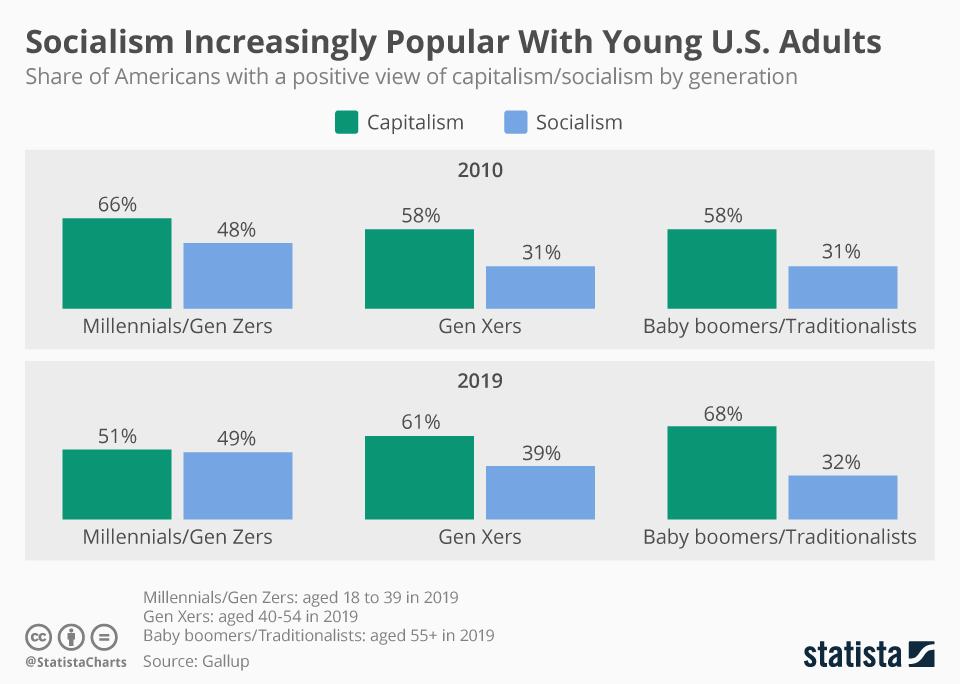

Socialism Increasingly Popular With Young U.S. Adults

Socialism

A new Gallup poll has found that young adults' opinions of capitalism have deteriorated since 2010 in the United States. Currently, both capitalism and socialism are tied in popularity among Millienials/Gen Zers (aged 18 to 39). The gap is far more pronounced among Gen Xers in the 40-54 age bracket where 61 percent support capitalism and 39 percent favor socialism. Among Baby boomers/Traditionalists, supprt for capitalism and socialism stands at 68 and 32 percent respectively.

Description

This chart shows the share of Americans with a positive view of capitalism/socialism by generation.