Largest banks in the United States - statistics & facts

JPMorgan Chase holds the top spot as the largest U.S. bank by assets, capturing over eight percent of the market. However, Bank of America stands out as the most valuable banking brand, highlighting its influence in both market presence and brand equity. These rankings highlight different aspects of success within the industry, and a deeper analysis of the largest banks considers other factors such as profitability, assets, and market share.

JPMorgan Chase: the leading U.S: bank in profitability

In 2023, JPMorgan Chase stood as the most profitable U.S. bank across all major indicators, including revenue, net income, return on equity (ROE), and return on assets (ROA). The bank's revenue exceeded 158 billion U.S. dollars in 2023, making it the most profitable bank based on revenue. In addition, its ROE of almost 16 percent was by far the highest ROE among the largest U.S. banks that year. However, while JPMorgan Chase excelled in profitability, certain financial stability indicators ranked other banks higher. TD Bank held the highest CET1 ratio, Goldman Sachs led in total capital ratio, and Capital One had the highest leverage ratio.Customers satisfaction with the largest banks

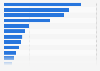

Capital One ranked highest in customer satisfaction among leading U.S. banks in 2023, excelling in areas like communication, convenience, and product resolution. JPMorgan Chase followed closely, and TD Bank placed third. In contrast, Citibank, Bank of America, and Wells Fargo ranked below the industry average. However, in terms of convenience, JPMorgan Chase stood out, leading in the number of active mobile banking users and ranking first in total branches, highlighting its broad accessibility across both physical and digital platforms.The U.S. banking sector remains dynamic, with strong competition across customer satisfaction and innovation. While Capital One excels in service quality, leaders like JPMorgan Chase dominate mobile banking and branch access. Looking to the future, digital transformation will play a key role, as shown by the rise in AI technology. Between 2021 and 2024, Capital One, Bank of America, and JPMorgan Chase led in AI patent filings, indicating a tech-driven direction for the industry.