Financial markets in Italy - statistics & facts

The Borsa Italia

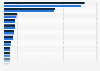

Otherwise called the Borsa Italia, the Milan Stock Exchange is one of Europe’s largest, with listed companies having a total market capitalization of around 700 billion euros. Two main markets comprise the Borsa Italiana: the Mercato Telematico Azionario (MTA), which is the segment for mid- and large-size companies; and the AIM Italia, which was established in 2009 to cater for high growth small and medium enterprises needing more flexibility around the reporting and governance requirements. Some of the better known companies on the Milan Stock Exchange are carmaker Ferrari, insurer Generali, and beverage producer Campari. Previously owned by the London Stock Exchange Group, in 2021 the operation of the Milan Stock Exchange was taken over by Euronext, the largest stock exchange operator in Europe.Other financial markets in Italy

Italy is one of the largest exporters in the world, being home to both a strong agricultural and manufacturing sector – with the latter including some of the world’s preeminent luxury goods and automobile brands. Accordingly, on top of the equity market, the outstanding debt of Italian corporations (in the form of bonds, notes, loans, and revolving credit facilities) totals over 180 billion euros, with the majority being considered investment grade, providing another market for investment. Further expanding the range of financial markets in Italy, the Milan Stock Exchange houses a derivatives market whose annual turnover is above 910 billion euros per year. On top of this, the daily turnover of the Italian over the counter (OTC) interest rate derivatives market totals around 21.4 million U.S. dollars per day. While none of these markets are individually world-leading, taken together they demonstrate how Italy is home to a large, developed financial sector.Italy’s financial markets reflect a dynamic blend of tradition and transformation. With a robust stock exchange, a large debt market and a focus on growth, Italy's financial sector has continued to expand, adapting to modern challenges since its inception in the early 19th century.