Impact of inflation on e-commerce – statistics & facts

What ensued was a cost-of-living crisis that shrunk people’s disposable incomes as prices of essential commodities like food and fuel soared. The European Union’s food inflation rate stubbornly remained in the double-digit domain, increasing from 10 percent in May 2022 to approximately 16.4 percent in April 2023.

Inflation-proof no more

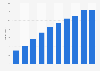

The recession that followed increased the cost of raw materials and goods sold on the market, but it particularly exerted pressure on energy and transportation costs. For an industry that heavily relies on last-mile delivery for order fulfillment, e-commerce was hit hard. In 2023, the increase of transportation and delivery costs was the leading concern for more than three-quarters of e-commerce merchants in France. In response, online retailers took measures to combat the impact of inflation, with more than 80 percent of them increasing their prices, and some 53 percent reducing their profit margins. In neighboring Italy, e-commerce companies reported decreasing profit margins to maintain similar prices in 2023.In the United States, online grocery prices witnessed unprecedented increases, with the highest online grocery inflation rate recorded in September 2022 at 14.3 percent. In Europe, the increase in online prices for alcoholic beverages was estimated at 11.4 percent in 2022.

How are online shoppers responding?

As of February 2023, rising prices for household goods were the leading concern for online shoppers worldwide. As inflation bit into their wallets, consumers adjusted their purchasing behavior accordingly. When asked about the top actions they took to face inflation, more than a third of global shoppers reported comparing product prices either online or in-store before making a purchase. Others reported waiting for products to be on sale, or postponed their purchase until sales events like Black Friday or Amazon Prime Day.In the United States, shoppers across generations reported making changes to their online shopping behavior in response to inflation. In February 2023, some 73 percent of Baby Boomers in the U.S. said they were buying discounted products online due to rising prices, and around 21 percent of their Gen Z counterparts reported engaging in secondhand e-commerce more due to inflation.

Is it too soon to talk of e-commerce disinflation?

With consumers tightening their purse, online retailers were faced not only with unsold inventory stock, but also lower profit margins. Many of them resorted to discounts and promotional offers in an effort to revitalize online spending. According to estimates, e-commerce discounts during the holiday season in 2022 averaged approximately 32 percent for computers, 27 percent for electronics, and 18 percent for apparel. It comes as no surprise that these promotional offers and price markdowns were higher in discretionary product categories, as rising prices for essential goods motivate consumers to postpone or do without purchases of non-essential items like apparel and consumer electronics.Recent data on online inflation in the United States seems to confirm this claim. As of June 2023, many discretionary product categories experienced year-on-year price decreases, most notably computers and electronics, which recorded online price decreases of approximately 17 percent and 13 percent, respectively. Other e-commerce categories like pet products, grocery, and apparel experienced disinflation: compared to double-digit price increases in November 2022, online grocery prices only increased by 7.5 percent in June 2023, indicating that e-commerce inflation is beginning to slow down.