Container carriers - statistics & facts

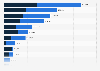

In 2022 alone, around 862 million twenty-foot equivalent units (TEU) worth of containerized goods were handled at ports worldwide. A few companies dominate the container shipping industry and utilize economies of scale to provide cost-effective transportation of a wide range of goods. The largest companies operate fleets with capacities well over a million TEUs.

Biggest container ship operators

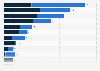

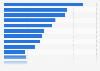

Four container ship operators – Mediterranean Shipping Company (MSC), APM-Maersk, CMA CGM, and COSCO—accounted for over half of the world’s container fleet capacity in 2023. The largest container company was MSC that year, controlling around 19.3 percent of the global fleet. The combined capacity of MSC’s ships reached over 5.3 million TEUs in 2023. Moreover, the company owns the largest container ship built to date. Ranking second, APM-Maersk operated 15 percent of the global fleet, boasting a fleet of 682 container ships. The Marseille-based company CMA CGM controlled 12.6 percent of the worldwide fleet. The total capacity of CMA CGM’s container vessels amounted to almost 3.5 million TEUs in 2025.Container line operators form alliances to maximize capacity utilization and offer vessel sharing to their members. Currently, three main alliances—2M Alliance, Ocean Alliance, and THE Alliance—dominate the industry. The combined market share of these shipping alliances amounted to some 75 percent between 2017 and 2021. Ocean Alliance and 2M Alliance each controlled around 29 percent of the global shipping market, while THE Alliance had a 17-percent market share in that period.

Impact of the Covid-19 pandemic

The COVID-19 pandemic was both a source of complications for the container shipping industry and opportunities. Port closures due to mandatory quarantines and labor shortages have led to ship congestions at some of the biggest ports in the world, most notably in China at the beginning of 2022. In turn, port congestions caused ship delays, making fleet management and ship capacity utilization rather tricky. Not surprisingly, capacity utilization of the global container fleet plummeted during the pandemic; in January 2022, almost 14 percent of the global fleet was not utilized due to port congestions and vessel delays. Demand for container shipping, however, increased by about 15 percent in the first five months of 2021 compared to 2020.With less capacity available and bunker fuel prices rising, freight rates surged in 2021 and 2022. Container lines took advantage of the disrupted market and were charging more than the increased costs of shipping demanded, thus recording record-high profit margins. In the second half of 2022, however, the market started to stabilize, putting pressure on container carriers to lower freight rates. As of 2023, freight rates have dropped to nearly pre-pandemic levels, leading to lower profits for the carriers.