Catalina Espinosa

Research expert covering society, economy, and politics for Europe and the EU

Detailed statistics

Inflation rate of the European Union 1997-2024

Detailed statistics

Inflation rate in Europe in October 2024, by country

Detailed statistics

Percentage of people who see inflation as an important issue EU 2016-2023

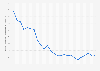

Inflation rate of the European Union 1997-2024

Harmonized index of consumer prices (HICP) inflation rate of the European Union from January 1997 to September 2024

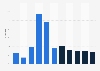

Inflation rate in Europe in October 2024, by country

Harmonized index of consumer prices (HICP) inflation rate in Europe in October 2024, by country

Inflation rate of the European Union 2002-2024, by category

Harmonized index of consumer prices (HICP) inflation rate of the European Union from January 2002 to October 2024, by category

Inflation rate of the European Union in 2023, by sector

Harmonized index of consumer prices (HICP) inflation rate of the European Union in December 2023, by sector

Producer price index in the EU 2011-2022

Producer price index (PPI) for manufacturing in the domestic market in the European Union (EU27) from January 2011 to December 2022 (2015 = 100)

CPI inflation rate among large economies in Western Europe 2010-2023

Annual inflation rate of the consumer price index (CPI) among large economies in Western Europe from January 2010 to November 2023

Inflation rate in the UK 2000-2024

Inflation rate for the Consumer Price Index (CPI) in the United Kingdom from January 2000 to November 2024

Monthly inflation rate in France August 2023

France: Inflation rate from January 2021 to August 2023 (compared to the same month of the previous year)

Monthly inflation rate in Germany 2022-2024

Inflation rate in Germany from November 2022 to November 2024 (changes compared to the same month last year)

Monthly consumer price index in Italy 2020-2024

Monthly consumer price index (CPI) in Italy from January 2020 to September 2024

Inflation rate in Spain 2017-2024, y-o-y by month

Percentage change of the consumer price index (CPI) on a year earlier in Spain from January 2017 to March 2024

CPI inflation rate in the Netherlands, per month 1963-2023

Percentage change on the previous year in CPI inflation rate in the Netherlands from January 1963 to September 2023

Monthly rate of inflation in Belgium 2018-2023

Monthly inflation rate in Belgium from January 2018 to September 2023 (change in HICP compared to same month in the previous year)

Monthly consumer price index in Poland 2018-2024

Monthly consumer price index (CPI) change of goods and services in Poland from 2018 to 2024

Monthly inflation rate in Russia 2022-2024

Russia: Inflation rate from April 2022 to October 2024 (compared to the same month of the previous year)

Year-on-year change in CPI in Turkey 2016-2024

Year-on-year change in Consumer Price Index (CPI) in Turkey from July 2016 to November 2024

Inflation rate in the European Union by sector 2019-2023

Monthly inflation rate in the European Union from January 2019 to December 2023, by sector

Inflation rate for food and non-alcoholic beverages in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for food and non-alcoholic beverages in the European Union from January 1997 to December 2023

Inflation rate for alcoholic beverages, tobacco and narcotics in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for alcoholic beverages, tobacco and narcotics in the European Union from January 1997 to December 2023

Inflation rate for clothing and footwear in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for clothing and footwear in the European Union from January 1997 to December 2023

Inflation rate for housing and energy in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for housing, water, electricity, gas, and other fuels in the European Union from January 1997 to December 2023

Inflation rate for furnishings and household equipment in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for furnishings, household equipment and routine household maintenance in the European Union from January 1997 to December 2023

Inflation rate for health in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for health in the European Union from January 1997 to December 2023

Inflation rate for transport in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for transport in the European Union from January 1997 to December 2023

Inflation rate for communications in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for communications in the European Union from January 1997 to December 2023

Inflation rate for recreation and culture in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for recreation and culture in the European Union from January 1997 to December 2023

Inflation rate for education in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for education in the European Union from January 1997 to December 2023

Inflation rate for restaurants and hotels in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for restaurants and hotels in the European Union from January 1997 to December 2023

Inflation rate for personal care in the EU 1997-2023

Harmonized index of consumer prices (HICP) inflation rate for personal care in the European Union from January 1997 to December 2023

Forecasts for the inflation rate of the Eurozone 2024-2026 by different institutions

Forecasted harmonized index of consumer prices (HICP) inflation rate for the Eurozone from 2024 to 2026, by different economic forecasters

Forecasted HICP inflation rate in the Eurozone by consumption category 2023-2026

Forecasted harmonized indices of consumer prices (HICP) inflation rate in the Eurozone currency area from 2023 to 2026, by consumption category

Inflation rate in EU and Euro area 2029

Inflation rate in the European Union and the Euro area from 2019 to 2029 (compared to the previous year)

CPI annual inflation rate UK 2000-2029

Annual inflation rate of the Consumer Price Index in the United Kingdom from 2000 to 2029

RPI annual inflation rate UK 2000-2029

Annual inflation rate of the Retail Price Index in the United Kingdom from 2000 to 2029

Fixed rate interest rates set by the ECB 2008-2024

Fluctuation of the European Central Bank fixed interest rate from 2008 to 2024

Central bank interest rates in the European Union 2022-2024, by country

Central bank interest rates in the European Union from January 2022 to December 2024, by country

Monthly inflation rate and central bank interest rate in Germany 2018-2024

Average inflation rate and European Central Bank (ECB) interest rate in the Germany from January 2018 to November 2024

Monthly inflation rate and central bank interest rate in the UK 2018-2024

Average inflation rate and central bank interest rate in the United Kingdom from January 2018 to November 2024

Forecasted interest rate on the ECB's main refinancing operations 2023-2025

Forecasted annual interest rate on the European Central Bank's (ECB) main refinancing operations from 2023 to 2025

Percentage of people who see inflation as an important issue EU 2016-2023

Percentage of people who see rising prices, inflation, and the cost of living as an important national issue in the European Union from 2016 to 2023

Percentage of people who see inflation an important issues in Britain 1974-2024

Percentage of people who think that inflation is one of the most important issues facing Great Britain from 1974 to 2024

Percentage of people who see inflation as an important issue EU 2023, by country

Percentage of people who see rising prices, inflation, and the cost of living as an important national issue in the European Union 2023, by country

Share of Europeans believing that inflation impacted the desire to travel 2023

Share of individuals who believed that inflation had an impact on the enthusiasm to travel in selected European countries as of April 2023

Opinions on best investments to counteract inflation in Germany in 2023, by gender

Which investment opportunities do you consider the most suitable for yourself to counteract rising inflation?

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)