Bicycle industry in Europe - statistics & facts

However, a broad range of cycling cultures remains across the continent. There are areas where cycling is strongly culturally embedded, such as the Netherlands and individual cities that have built on the popularity of cycling during the pandemic and have subsequently continued improving their cycling infrastructure.

From supply chain disruptions to over-supply

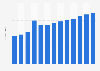

As demand for bicycles surged in Europe during the pandemic, supply chain problems constrained manufacturers' ability to meet this increasing demand. Bicycle suppliers reported waiting times of more than one year to fulfill orders of new bikes. By 2023 supply chain difficulties had eased, but bicycle sellers began facing a different problem. Consumer demand for bikes returned to levels comparable to before the pandemic, but suppliers now held an oversupply of new bikes and components. Subsequently, bike imports to the EU dropped nearly 40 percent from their peak in 2021 to the lowest level in over ten years.Most bikes imported to the EU in 2023 originated from Cambodia, accounting for close to a quarter of imports. Anti-dumping measures introduced by the EU in 2019 had already reduced the import of bicycles to the trading bloc from China, the second-largest supplier in 2023, and had also strengthened domestic production. Portugal's bicycle and component manufacturing sector has been able to profit particularly strongly from the return of production of bicycles for the European market to the continent. Historically, Germany and Italy had been the largest bicycle producers in Europe but have been overtaken by Portugal in recent years, which now produces more than a fifth of all bikes manufactured in the EU.