April 20, or 4/20, is a day commonly used to push for cannabis legalization and to celebrate the drug's use - both recreationally and medically. Recreational marijuana has by now been made legal in 21 U.S. states and the District of Columbia. There are currently 37 states that have medical marijuana laws, including all that allow recreational use.

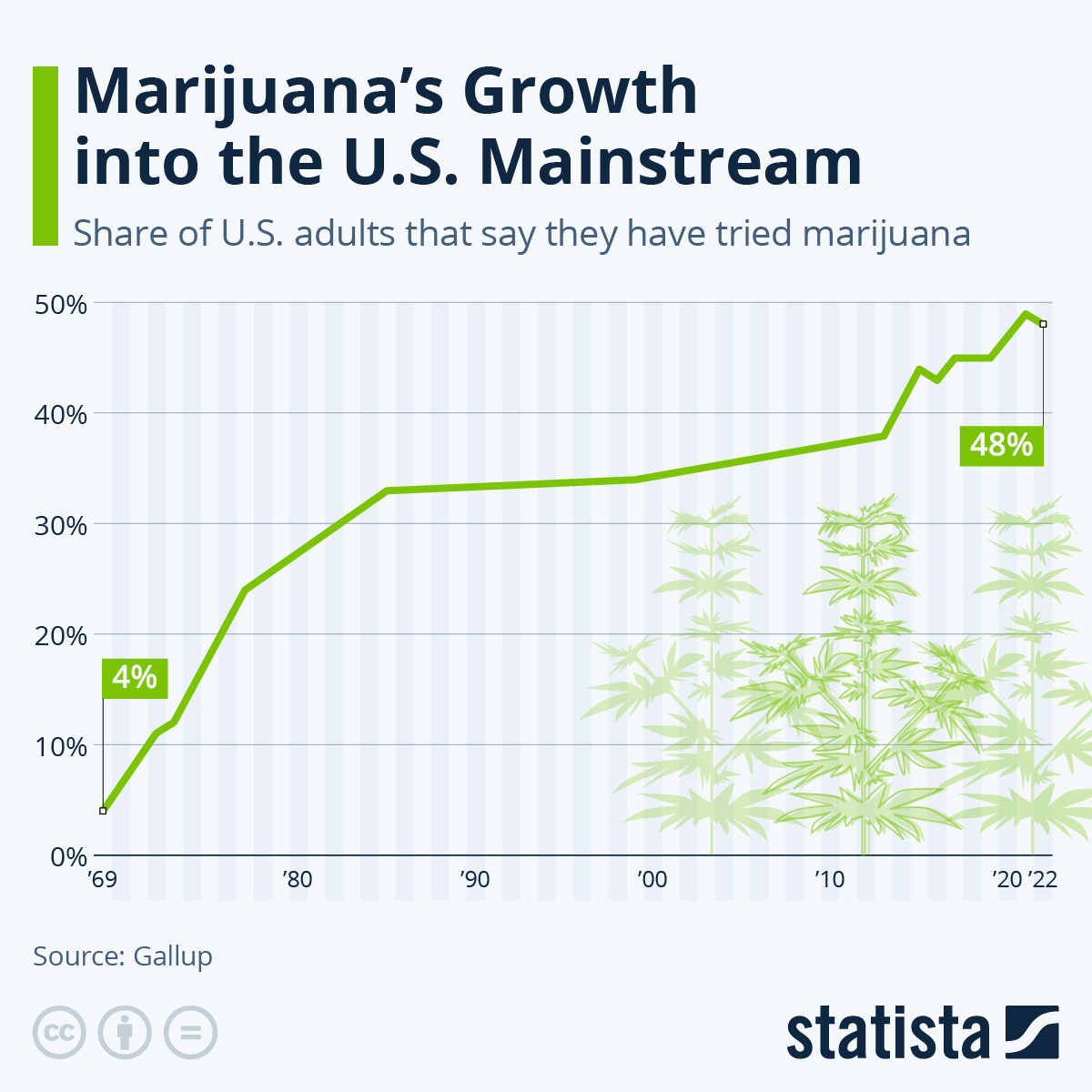

The rise of cannabis into the U.S. mainstream can be tracked in our infographic, which shows the rising share of U.S. adults saying that they have tried the drug. Back in 1969, only 4% said they had tried the drug, but, as noted by Gallup: "That surpassed 20% in 1977, 30% in 1985 and 40% in 2015." The figure is now hovering below the 50% mark.

When it comes to regular use there is a way to go however. Just 16 percent of U.S. adults said they "smoke marijuana" in 2022, as opposed to having simply tried it at some point.