Reinsurance - statistics & facts

Ever-evolving challenges

The reinsurance industry has faced continuous challenges including a volatile global inflation rate, rapid regulatory changes, and climate change. More recent challenges include increased cybercrime, which has led to senior executives providing opinions on levels of insurance coverage to be provided against cyber-attacks. Reinsurance companies must reassess business models on a regular basis to stay compliant with increasing industry and client needs while also remaining profitable. The capital value of the global reinsurance industry has experienced a decline since its peak in 2021. However, the industry has worked to embrace the intensifying levels of challenges.Industry players

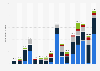

Reinsurers have adapted by expanding into new markets and investing in technology to improve efficiency and enhance their risk management capabilities. Having faced ongoing challenges, leading players in the global reinsurance industry such as Munich Re and Hannover Re have continued to generate a positive return on equity. Notably, the top three leading reinsurance players worldwide were domiciled in Europe; However, the U.S. market was also quite significant, as the size of the U.S. reinsurance carrier market has grown year-on-year since 2011.As the backbone of the insurance sector, reinsurance is a contract between a reinsurer and an insurer, where the ceding party transfers insured risk to the reinsurance company, reducing the risk of large payouts for claims.