Lionel Sujay Vailshery

Research expert covering cloud computing and emerging tech industries

Microsoft Azure and Google Cloud Platform (GCP) are locked in an epic battle for cloud supremacy. Microsoft, a titan of the traditional software world, with a robust suite of SaaS offerings like the popular Microsoft Dynamics 365 and Dynamics, seamlessly integrated with its on-premise solutions. This established ecosystem provides a strong value proposition for businesses wary of a complete cloud migration. Alphabet, on the other hand, leverages its unparalleled artificial intelligence and machine learning expertise to empower GCP with cutting-edge AI and analytics capabilities. This attracts data-driven organizations seeking to unlock the power of big data. Both companies are fiercely investing in global expansion and industry-specific solutions, making them also some of the front-runners in the cloud business.

Salesforce, the undisputed customer relationship management (CRM) kingpin, continues to reign supreme with its comprehensive CRM platform. Its focus on user experience, coupled with a thriving app ecosystem with integration of generative AI, allows businesses to tailor Salesforce to their specific needs. Oracle, though primarily known for its enterprise database software, has made significant strides in the SaaS arena with Oracle Cloud Infrastructure (OCI) and Oracle Fusion Cloud Applications. OCI offers a competitive alternative to the big two (Microsoft and Alphabet) for cost-conscious organizations, while Fusion Cloud Applications caters to specific industry verticals with ready-made solutions. Both Salesforce and Oracle excel at catering to the unique requirements of their customer segments, ensuring their sustained relevance in the SaaS market.

The SaaS landscape is evolving rapidly, driven by factors such as niche solutions, AI, data privacy, and multi-cloud strategies. Businesses must carefully evaluate providers and their ability to adapt to these trends that may or may not align with the strategy and vision of the organization to succeed in the future. Additionally, the increasing importance of sustainability in technology will likely influence the development and adoption of SaaS solutions in multi-cloud environments.

Detailed statistics

Global public cloud application services (SaaS) market size 2015-2025

Detailed statistics

Global public cloud application services (SaaS) market size 2015-2025

Detailed statistics

Enterprise cloud computing challenges 2019-2024

Detailed statistics

Enterprise cloud computing challenges 2019-2024

Detailed statistics

Enterprise software total worldwide expenditure 2009-2025

Detailed statistics

Enterprise software total worldwide expenditure 2009-2025

Leading SaaS companies worldwide 2025, by market cap

Leading software as a service (SaaS) companies worldwide as of May 2025, by market capitalization (in billion U.S. dollars)

Leading SaaS companies worldwide 2025, by market cap

Leading software as a service (SaaS) companies worldwide as of May 2025, by market capitalization (in billion U.S. dollars)

Public cloud services growth worldwide 2023-2025, by segment

Public cloud services annual growth rate worldwide in 2023 to 2025, by segment

Public cloud services growth worldwide 2023-2025, by segment

Public cloud services annual growth rate worldwide in 2023 to 2025, by segment

Global organizations data move to public cloud 2024

Worldwide organizations data move to public cloud in 2024

Global organizations data move to public cloud 2024

Worldwide organizations data move to public cloud in 2024

Global commercial as-a-service sector ACV worldwide 2020-2024, by type

Annual contract value (ACV) for the global commercial as-a-service sector from 2020 to 2024 (in billion U.S. dollars), by type

Global commercial as-a-service sector ACV worldwide 2020-2024, by type

Annual contract value (ACV) for the global commercial as-a-service sector from 2020 to 2024 (in billion U.S. dollars), by type

Global anticipated cloud initiatives worldwide 2024

Leading cloud initiatives anticipated worldwide for 2024

Global anticipated cloud initiatives worldwide 2024

Leading cloud initiatives anticipated worldwide for 2024

Public cloud services end user spending worldwide 2021-2025, by segment

Public cloud services end user spending worldwide from 2021 to 2025, by segment (in million U.S. dollars)

Public cloud services end user spending worldwide 2021-2025, by segment

Public cloud services end user spending worldwide from 2021 to 2025, by segment (in million U.S. dollars)

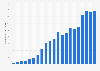

Microsoft revenue 2002-2024

Revenue of Microsoft from 2002 to 2024 (in billion U.S. dollars)

Microsoft revenue 2002-2024

Revenue of Microsoft from 2002 to 2024 (in billion U.S. dollars)

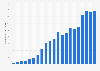

Apple revenue worldwide 2004-2024

Global revenue of Apple from 2004 to 2024 (in billion U.S. dollars)

Apple revenue worldwide 2004-2024

Global revenue of Apple from 2004 to 2024 (in billion U.S. dollars)

Alphabet: global annual revenue 2011-2024

Annual revenue of Alphabet from 2011 to 2024 (in million U.S. dollars)

Alphabet: global annual revenue 2011-2024

Annual revenue of Alphabet from 2011 to 2024 (in million U.S. dollars)

Oracle: revenue by segment 2008-2024

Oracle's revenue by business segment from FY2008 to FY2024 (in million U.S. dollars)*

Oracle: revenue by segment 2008-2024

Oracle's revenue by business segment from FY2008 to FY2024 (in million U.S. dollars)*

Salesforce revenue 2010-2024

Salesforce.com's revenue from 2010 to 2024 (in billion U.S. dollars)

Salesforce revenue 2010-2024

Salesforce.com's revenue from 2010 to 2024 (in billion U.S. dollars)

Revenue of Microsoft broken down by segment 2012-2024

Microsoft's revenue from financial years 2012 to 2024, by segment (in billion U.S. dollars)

Revenue of Microsoft broken down by segment 2012-2024

Microsoft's revenue from financial years 2012 to 2024, by segment (in billion U.S. dollars)

Apple's revenue 2000-2024, by operating segment

Revenue of Apple from 2000 to 2024, by operating segment (in billion U.S. dollars)

Apple's revenue 2000-2024, by operating segment

Revenue of Apple from 2000 to 2024, by operating segment (in billion U.S. dollars)

Alphabet: global annual revenue 2017-2024, by segment

Annual revenue of Alphabet from 2017 to 2024, by segment (in million U.S. dollars)

Alphabet: global annual revenue 2017-2024, by segment

Annual revenue of Alphabet from 2017 to 2024, by segment (in million U.S. dollars)

Oracle breakdown of revenue 2009-2024, by business division

Share of revenue of Oracle from 2009 to 2024, by business division

Oracle breakdown of revenue 2009-2024, by business division

Share of revenue of Oracle from 2009 to 2024, by business division

Revenue of Salesforce.com broken down 2009-2024, by segment

Salesforce.com's revenue from 2009 to 2024, by segment (in million U.S. dollars)

Revenue of Salesforce.com broken down 2009-2024, by segment

Salesforce.com's revenue from 2009 to 2024, by segment (in million U.S. dollars)

Industries with the highest share of unicorns globally 2023

Industries with the highest share of unicorns worldwide as of 2023

Industries with the highest share of unicorns globally 2023

Industries with the highest share of unicorns worldwide as of 2023

Main cloud initiatives in global organizations 2024

Organizations prioritized cloud initiatives worldwide in 2024

Main cloud initiatives in global organizations 2024

Organizations prioritized cloud initiatives worldwide in 2024

Global companies management of cloud services costs 2024

Organizations cost management of software as a service (SaaS) and software compared to infrastructure as a service (IaaS)/platform as a service (PaaS)

Global companies management of cloud services costs 2024

Organizations cost management of software as a service (SaaS) and software compared to infrastructure as a service (IaaS)/platform as a service (PaaS)

Global companies leader of cloud cost management 2024

Who in your organization leads cloud cost management responsibilities?

Global companies leader of cloud cost management 2024

Who in your organization leads cloud cost management responsibilities?

Global organizations planned prioritized initiatives 2024

Global organizations planned prioritized initiatives for the next year in 2024

Global organizations planned prioritized initiatives 2024

Global organizations planned prioritized initiatives for the next year in 2024

Leading global ERP software market share by company 2024

Market share of leading enterprise resource planning (ERP) software companies worldwide in 2024

Leading global ERP software market share by company 2024

Market share of leading enterprise resource planning (ERP) software companies worldwide in 2024

Revenue of the ERP software industry worldwide 2020-2029

Revenue of the enterprise resource planning software market worldwide from 2020 to 2029 (in billion U.S. dollars)

Revenue of the ERP software industry worldwide 2020-2029

Revenue of the enterprise resource planning software market worldwide from 2020 to 2029 (in billion U.S. dollars)

Share of ERP implementation projects experienced budget overruns worldwide 2011-2024

Percentage of enterprise resource planning (ERP) implementation projects overrunning budgets from 2011 to 2024

Share of ERP implementation projects experienced budget overruns worldwide 2011-2024

Percentage of enterprise resource planning (ERP) implementation projects overrunning budgets from 2011 to 2024

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)