Quick commerce in Indonesia - statistics and facts

Q-commerce is here to stay

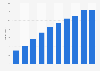

Q-commerce began gaining traction in Indonesia at the height of the COVID-19 pandemic. Many consumers were concerned about how to shop for groceries and other essential items safely, conveniently, and quickly. Q-commerce services emerged to meet consumer expectations. Built upon conventional e-commerce features, q-commerce is also considered the third generation of trade that emphasizes the high-speed delivery of products and services. However, unlike e-commerce, which relies on centralized warehouses mostly placed on the outskirts of a city to minimize costs, q-commerce depends on micro warehouses. These warehouses are commonly known as dark stores that are strategically located and distributed in residential areas to ensure instant delivery after the order is placed. A recent study found that most q-commerce users in Indonesia considered a delivery time of up to two hours to be the ideal delivery duration for a quick commerce service. Due to almost instant delivery, q-commerce appeals to spontaneous consumers as well as working professionals with busy lifestyles. In 2022, more than 16 million Indonesians were q-commerce users. This number is forecast to grow by almost eight million by 2027.Three Indonesian startups, ASTRO, Bananas, and Dropezy, entered the q-commerce market after bagging millions of U.S. dollars’ worth of funding between 2021 and 2022. ASTRO even made it to the list of quick commerce startups with the highest funding worldwide in early 2022. However, the quick commerce arena is not exclusive to new players. By taking advantage of their existing delivery networks, supply chains, and established e-commerce as well as on-demand services, multi-service technology platforms such as Gojek and Grab also developed their own q-commerce services. GoMart, operated by Gojek Indonesia, was the most popular q-commerce platform among users in Indonesia as of October 2022.