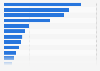

Market share of leading banks in the U.S. 2023, by total assets

JPMorgan Chase was the leading bank in the United States as of December 2023, with its market share of total assets amounting to 8.56 percent. This means that the value of assets of JPMorgan Chase was equivalent to 8.56 percent of the total value of assets of all FDIC-insured institutions in the United States. Bank of America and Wells Fargo followed, with 6.4 and 4.37 percent of the total banking assets, respectively. The value of JPMorgan Chase's total assets exceeded 3.3 trillion U.S. dollars in 2023.

JPMorgan Chase: an industry leader in U.S. banking

JPMorgan Chase is undoubtedly one of the leading financial services companies in the United States. It does not only rank first in terms of market share of total assets, but it also has the largest market capitalization and value of total and domestic deposits. The New York-based banking giant is also among the largest banks globally. In terms of assets, JPMorgan Chased ranked fifth in 2022, with only four Chinese banks having had higher amounts of assets.

Bank failures in the U.S.

The failures of Silicon Valley Bank (SVB) and Signature Bank in March 2023 marked the first bank failures in the U.S. since 2021. The total assets lost in the failure of these two banks amounted to 319.4 billion U.S. dollars. In comparison, the total assets of the 371 U.S. bank failures between 2010 and 2022 amounted to 168 billion U.S. dollars. Both SVB and Signature Bank had a disproportionately low share of deposits of less than 250,000 U.S. dollars in the fourth quarter of 2022 (2.7 percent and 6.2 percent, respectively), which meant that the majority of deposits held at these banks were not secured by the FDIC.