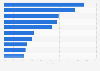

Distribution of global Islamic fund assets 2022, by domicile

In 2022, the largest share of about 38.1 percent of the Islamic fund assets worldwide were in Malaysia. It was followed by Saudi Arabia, which had about 27.5 percent of the total Islamic fund assets.

Islamic fund assets

The Islamic funds segment has always been less popular than other conventional funds and are still under development with an opportunity for further growth. Many Muslim majority jurisdictions with a functioning Islamic finance regulatory framework and banking sector still have small Islamic funds segments. They are available in 28 jurisdictions, with five of those jurisdictions accounting for more than 90 percent of the total assets under management. Islamic funds have a limited scale as they are mostly concentrated in Saudi Arabia, Malaysia, and Iran. The Gulf Cooperation Council region held the largest value of approximately 36 billion U.S. dollars of Islamic fund assets in 2019. The most common Islamic fund asset worldwide is equity assets. The total value of assets under management of the Islamic funds sector has been increasing, supported by growth in the equity markets.

Islamic financial services

Islamic financial institutions offer a variety of Islamic financial services such as Islamic banking, sukuk, Islamic funds, and takaful. Islamic banking was the most popular service with a share exceeding 70 percent of the global Islamic banking services worldwide. The largest Sharia’ah compliant bank was Ayandeh Bank of Iran with assets exceeding 26 billion U.S. dollars in 2019. Further growth of the current Islamic services requires the simultaneous development of other segments of the Islamic capital market to offer a wider range of Islamic financial instruments for assets managers.

Islamic fund assets

The Islamic funds segment has always been less popular than other conventional funds and are still under development with an opportunity for further growth. Many Muslim majority jurisdictions with a functioning Islamic finance regulatory framework and banking sector still have small Islamic funds segments. They are available in 28 jurisdictions, with five of those jurisdictions accounting for more than 90 percent of the total assets under management. Islamic funds have a limited scale as they are mostly concentrated in Saudi Arabia, Malaysia, and Iran. The Gulf Cooperation Council region held the largest value of approximately 36 billion U.S. dollars of Islamic fund assets in 2019. The most common Islamic fund asset worldwide is equity assets. The total value of assets under management of the Islamic funds sector has been increasing, supported by growth in the equity markets.

Islamic financial services

Islamic financial institutions offer a variety of Islamic financial services such as Islamic banking, sukuk, Islamic funds, and takaful. Islamic banking was the most popular service with a share exceeding 70 percent of the global Islamic banking services worldwide. The largest Sharia’ah compliant bank was Ayandeh Bank of Iran with assets exceeding 26 billion U.S. dollars in 2019. Further growth of the current Islamic services requires the simultaneous development of other segments of the Islamic capital market to offer a wider range of Islamic financial instruments for assets managers.