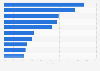

Value of sukuk assets outstanding 2022, by region

The value of assets outstanding of sukuk in South-East Asia amounted to 411.4 billion U.S. dollars in 2022. In that year, the total value of sukuk assets worldwide was over 829.7 billion U.S. dollars.

Islamic financial product

Sukuks are a financial product in accordance to Sharia law. It is a financial certificate comparable to a bond which allows the issuer to sell those sukuks to investors in order to purchase an asset of which investors have a partial ownership. The sukuk issuer is contractually bound to buy back those sukuks at a future date as per the value. The main difference between a sukuk and a conventional bond is the abstention from accumulating interest. Malaysia is the leading issuer of sukuk outstanding assets worth about 219 billion U.S. dollars, followed by Saudi Arabia and Indonesia.

Sukuk categories

The value of sovereign issued sukuks amounted to 69 billion U.S. dollars, while the value of corporate issued bonds totaled only 24.4 billion U.S. dollars. Besides governments and financial institutes, the utility and the industrial sector are main issuers of sukuk bonds.

Islamic financial product

Sukuks are a financial product in accordance to Sharia law. It is a financial certificate comparable to a bond which allows the issuer to sell those sukuks to investors in order to purchase an asset of which investors have a partial ownership. The sukuk issuer is contractually bound to buy back those sukuks at a future date as per the value. The main difference between a sukuk and a conventional bond is the abstention from accumulating interest. Malaysia is the leading issuer of sukuk outstanding assets worth about 219 billion U.S. dollars, followed by Saudi Arabia and Indonesia.

Sukuk categories

The value of sovereign issued sukuks amounted to 69 billion U.S. dollars, while the value of corporate issued bonds totaled only 24.4 billion U.S. dollars. Besides governments and financial institutes, the utility and the industrial sector are main issuers of sukuk bonds.