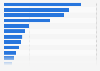

CET1 ratio of the largest banks in the U.S. 2024

In the fourth quarter of 2024, TD Bank's U.S. operations distinguished itself with the highest common equity tier 1 (CET1) capital ratio among major U.S. banks by total assets. The bank's CET1 ratio of 16.65 percent significantly surpassed the regulatory minimum of 4.5 percent. By comparison, JPMorgan Chase, the largest U.S. bank, recorded a CET1 ratio of 15.68 percent during the same period.

What is CET1 capital ratio?

The Basel III framework, established by the Basel Committee on Banking Supervision, sets international standards for bank capital requirements to ensure global financial stability. Developed in response to the 2007-2009 financial crisis, these regulations require banks to maintain adequate capital to withstand unexpected losses and economic downturns. The framework mandates a total capital requirement of eight percent of risk-weighted assets, with Common Equity Tier 1 (CET1) - the highest quality capital - comprising at least 4.5 percent of that total. In 2024, JPMorgan Chase had the highest Tier 1 capital among all banks in the United States.

Worldwide Tier 1 capital levels of banks

JPMorgan Chase, while leading U.S. banks in Tier 1 capital, ranked fifth globally in 2023. Four Chinese banks outperformed it: Industrial and Commercial Bank of China (ICBC), China Construction Bank, Agricultural Bank of China, and Bank of China. Among these, ICBC emerged as the world's top bank in Tier 1 capital.