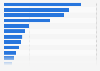

Leading banks in the U.S. 2023, by net income

JPMorgan Chase dominated the U.S. banking landscape in 2023, reporting a net income of 47.5 billion U.S. dollars, almost 20 billion more than Bank of America, which ranked second. Wells Fargo ranked third, with a net income of roughly 22 billion U.S. dollars. These three banks were also the largest banks based on total assets. The substantial lead held by JPMorgan Chase underscores its position as the financial powerhouse among American banks, reflecting its robust performance across various banking sectors.

Market capitalization and global standing

JPMorgan Chase's financial prowess extends beyond net income. With a market capitalization of 491.76 billion U.S. dollars as of December 31, 2023, it stood as the most valuable bank in the United States. Its massive market capitalization also made it the largest bank globally, with Bank of America following from a distance. This impressive valuation, coupled with its substantial net income, cements JPMorgan Chase's status as a financial titan.

Asset base of JPMorgan Chase

JPMorgan Chase's leadership is also evident in its asset base. The bank held 8.56 percent of total banking assets in the United States as of December 2023, surpassing Bank of America and Wells Fargo. This substantial market share translated to over 3.9 trillion U.S. dollars in total assets.