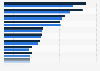

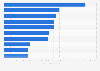

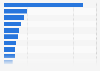

Largest IPOs worldwide as of 2024

The initial public offering (IPO) of Saudi Aramco, the Saudi Arabian multinational petroleum and natural gas company, on the Tadawul in December 2019, was the largest public offering globally ever as of December 2024. The IPO of Saudi Aramco raised approximately 25.6 billion U.S. dollars.

Why do companies opt for IPOs?

An initial public offering (IPO), also known as ‘going public’, is the company’s first stock sale to the public. IPO happens when an initially private company decides to open up to the stock market, taking the first step to become a publicly traded enterprise. Shares are traded in the open market after the initial sales, and any public investor can take part on the trade. In the United States alone, 154 companies made their public-market debut in 2023. IPOs are made by different companies for a number of reasons. Smaller sized companies may seek an IPO for access to capital and cheaper credit for further expansion. Other companies that may already be of considerable size, however, may use an initial public offering to other ends. Opening up to the stock market can also facilitate merger and acquisitions, considering stocks can be part of a future deal.

Chinese companies feature twice

Two Chinese companies featured in the list as of 2024. Alibaba had the second largest after Saudi Aramco, with the Industrial and Commercial Bank of China (ICBC) in tenth place. Alibaba is listed on the New York Stock Exchange (as well as the Hong Kong Exchange), making the company’s IPO also the largest one in the U.S. to date. ICBC is listed on the Shanghai Stock Exchange and the Hong Kong Stock Exchange.