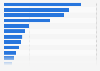

Number of personal loan under supervision accounts Thailand 2024, by operator

As of March 2024, non-bank operators oversaw more than 20.41 million personal loan accounts under the supervision of the Bank of Thailand. Meanwhile, there were approximately 3.7 million personal loan accounts with commercial banks in Thailand.

Personal loans in Thailand

The Ministry of Finance and the Bank of Thailand (BOT) oversee regulations for personal loans in Thailand. Personal loans under supervision are loans lent to individuals without specified purposes and collateral requirements. It covers hire-purchase and leasing items that the lessor does not sell, such as purchasing electrical appliances in department stores with the money obtained from a personal loan under the supervision of a bank (except for cars and motorcycles). As of March 2024, there were over three million personal loan accounts with commercial banks in Thailand. The annual interest rate and repayment period for personal loans under supervision also vary, but comply with the BOT guidelines.

Digital lending and personal loans

The technology evolution makes it easier to borrow and lend money online. Digital lending or online loans are offered through various platforms, both from traditional banks and non-bank operators. Many leading online platforms, including trading platforms, allow individuals to apply for loans to be used within their ecosystems: the loans would be converted to credits or services available on sites. For instance, Grab Thailand offers loans with a maximum amount of 500 thousand Thai baht to merchant partners who earned a minimum of 50 thousand Thai baht per month in the six months prior. The BOT categorizes this type of loan as nano finance under supervision. Given the various kinds of digital loans and the ease of attaining one, many overspend and fall victim to scams. As of March 2024, there were more than 850 thousand outstanding personal loan accounts under supervision in Thailand.