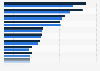

Major oil companies' quarterly net profits 2021-2024, by company

The net income of major oil and gas companies in the fourth quarter of 2024 shows a mixed picture. Some players, particularly BP, experienced significant losses amid lower refining margins. Meanwhile, TotalEnergies was the only company to note a quarter-on-quarter increase in profits.

Saudi Aramco continues to dominate the sector, with net earnings exceeding 22 billion U.S. dollars. This performance underscores the continued financial strength of state-owned oil enterprises in a volatile global energy market.

State-owned giants lead production and profits

Saudi Aramco's financial dominance is rooted in its unparalleled production output. The company extracts approximately 11.5 million barrels of crude oil and associated liquids per day, more than four times that of its closest competitor. This vast output dwarfs that of private companies like ExxonMobil, which produces around 2.4 million barrels daily. The scale of state-controlled oil companies extends beyond production to reserves as well, with Saudi Aramco holding nearly 251 billion barrels of proved hydrocarbon reserves in 2023, over ten times ExxonMobil's reported reserves.

Shifting strategies in a changing industry

As the oil and gas sector faces pressure to adapt to climate concerns, companies are diversifying their portfolios. Shell has maintained the highest brand value among oil and gas companies, estimated at 50.3 billion U.S. dollars in 2024, partly due to its increased focus on low-carbon investments. TotalEnergies is leading the supermajors in capital expenditure on renewables and other low-carbon sources, spending 5.88 billion U.S. dollars in 2023. In contrast, ExxonMobil allocated just 0.62 billion U.S. dollars to such initiatives, while Saudi Aramco's low-carbon investments remain limited to blue ammonia production and solar project investments.