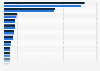

ASX options market volume Australia 2020-2024, by type

In May 2024, over six million options were traded on the Australian Securities Exchange (ASX). This is above the monthly average of around 5.5 million recorded since January 2020, and an increase from the 5.18 million recorded in the previous month. However, The ASX options market is much lower than the volume of futures traded on the ASX. Options and futures are similar in that they are both financial derivatives that provide an investor the ability to buy (or sell) a financial asset for an agreed price at a certain point in time, but they differ in that futures require that the transaction take place, whereas options do not.

Options and the coronavirus pandemic

Coinciding with the global coronavirus (COVID-19) pandemic, the volume of options traded on the Australian Securities Exchange (ASX) spiked in March 2020. It is notable that the spike in terms of the value of options traded was much greater than in terms of volume. It is also notable that the majority of the spike in this month came from call options - which enable the option holder to purchase a financial instrument (like shares) for an agreed price at a date in the future. By contrast, put options enable holders to sell a financial instrument at an agreed value in the future. This suggests that the increased value for this month was driven by investors trying to capitalize on the pandemic by locking in lower prices for the future, with the (correct) assumption that prices would rise again in the following months.

How is the value of derivatives calculated?

Calculating the value of derivatives is different to an item like shares, in that derivatives contracts do not include the underlying asset price. Both options and futures are contracts which provide the ability to purchase a financial asset in the future for an agreed price – meaning the purchase of the contract does not include the purchasing of the asset itself. Generally, the ‘notional value’ is used to calculate the value of derivatives – which includes both the cost of the contract itself as well as the underlying asset. Note how options do not require the transaction take place, but yet the value of transaction is included. This one reason behind why, for example, banks in the U.S. and banks in the UK can hold derivates that are well above the national gross domestic product of their respective countries.