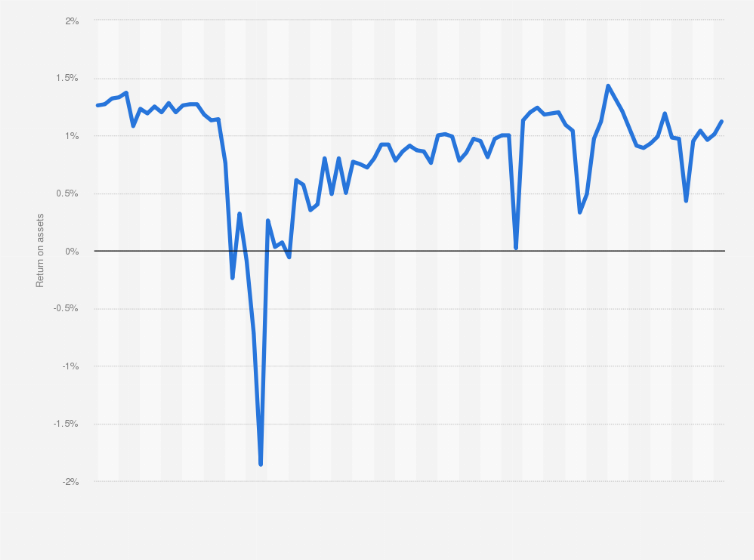

Quarterly ROA of the U.S. banking industry 2003-2025

The U.S. commercial banking industry's return on assets (ROA) has experienced dramatic shifts over two decades. Peaking at

Log in or register to access precise data.

Log in or register to access precise data.

Log in or register to access precise data.

Log in or register to access precise data.

Log in or register to access precise data.

Steady growth amidst fluctuations in net operating income

Despite the lowest quarterly net operating income of the U.S. banking industry being measured in the fourth quarter of 2008, at a negative

Log in or register to access precise data.

Stability and resilience in capital adequacy

The common equity tier 1 (CET1) ratio of the U.S. commercial banking industry has shown resilience, with an upward trajectory throughout 2024. Despite sharp decreases due to global financial crises and the COVID-19 pandemic, the industry has demonstrated stability and gradual recovery in its capital adequacy, culminating in a ROA of

Log in or register to access precise data.