Unleashing Artificial Intelligence's true potential › Chapter 1

If Big Data is the new oil, AI is the new electricity

July 2023

Jonah Trenker, Sai Satkriti Menon, Naveen Tavva, Christoph Blumtritt

Bringing together data-driven intelligence, expert perspectives, and extensive research to provide insights and future outlooks on current trends, market data, and key player strategies in the Artificial Intelligence market.

What to learn in this chapter?

• What has been the history of AI so far, and how did it come to be the modern, rising trend that no one can ignore?

• What is AI, how does it differ from machine learning and data science, and how is it segmented?

• What is the possible total addressable market of AI until 2030?

• What is the size of the global AI market and how will it change between now and 2030?

• How would the prospective AI market affect GDP?

• What is the current state of the finance and investment landscape, and how are specific regions and industries developing?

• How is the stock market developing since the AI liftoff and what are key players in the general AI market?

With the breakthrough of generative AI, we are now able to see that AI is more than just a buzzword and has the potential to solve many real-world problems

Artificial Intelligence (AI) is experiencing a surge in popularity, thanks to recent advances in generative AI, particularly with the release of ChatGPT. In contrast to other trending topics such as cryptocurrencies, NFTs, and Web 3.0, which have lost momentum due to economic challenges, AI is proving to be a powerful technology capable of solving real-world problems and streamlining complex tasks across a wide range of industries.

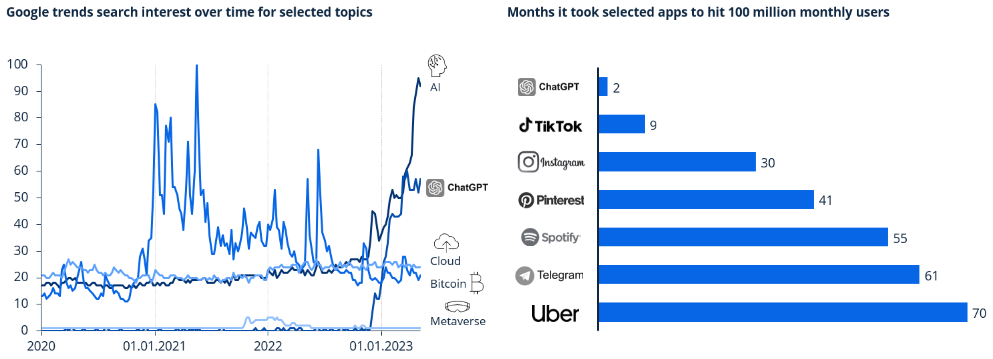

After the release of ChatGPT, Google trends search volume for AI skyrocketed. In just two months, ChatGPT reached 100 million monthly users. Chatbots like GPT are just the tip of the iceberg when it comes to recent advancements in AI. The field is experiencing a flurry of invention and development, with new tools and technologies emerging daily. AI is becoming increasingly accessible and useful for businesses, with new applications in healthcare, finance, and other industries. As AI tools become more advanced and capable of larger tasks, the possibilities for AI are boundless.

Sources: Statista Market Insights; Google Trends

General-purpose AI technology focuses on creating systems and machines capable of solving problems that normally require human intelligence, laying the foundation for a diverse range of AI technologies

• AI as a broader field, incorporates both data science and machine learning, along with other areas such as natural language processing, computer vision, and robotics. Whereas data science provides the foundation for understanding and working with data, machine learning enables AI systems to learn from that data and make intelligent decisions. AI expands beyond the scope of data science and machine learning to include the simulation of human intelligence, reasoning, perception, and interaction with the environment.

• AI technology is used to automate tasks and processes that are too complex for traditional computers to perform. This includes performing data analysis, forming predictions and decisions, and even developing systems that can interact with humans in a natural, conversational manner.

• AI is being used from healthcare and finance to transportation and logistics. For instance, finance AI technology is used to automate customer service, analyze data to provide personalized recommendations, and detect fraud in financial transactions.

• The field of generative machine learning has recently experienced an explosion of new tools and technology.

• Access to private APIs and open-source models drive progress for generative machine learning. In contrast to previous years, developers now have the opportunity to access private APIs, such as those provided by OpenAI and AI21 Labs, as well as open-source models for generative machine learning.

• Within the last month, for example Meta and Huggingface have shown support by sponsoring open-source models.

In an optimistic scenario, the total addressable AI market in 2030 might be close to US$16 trillion, adding 9.4% to global GDP

The scenario analysis shows the potential market value for AI. We assume different scenarios to account for a different adoption across potential markets

• The scenarios account for a certain shift of AI into all applicable markets for an estimated lower and higher adoption over time

• Applicable markets in this sense are markets such as digital health and manufacturing where AI could play a role

• A percentage share for several industries where a shift to AI can take place is calculated according to industry impact, maturity, impact over time, and overall use of AI

Sources: Statista Market Insights

The global AI market size was estimated to be US$204 billion in 2023 and is expected to continue growing to US$755 billion in 2030. This growth is driven by advancements in algorithms, machine learning techniques, and natural language processing, enabling the development of sophisticated autonomous AI systems. The market increased significantly between 2022 and 2023, increasing by more than 50%, mostly due to an increase in productivity, growing AI adoption and the strong advancements in generative AI. Looking at other technology markets, AI also shows the strongest CAGR for the period from 2020 to 2027 with 23.7%.

Sources: Statista Market Insights

The outcome of the different scenarios is calculated and based on different assumptions for the adoption of AI. The numbers show the potential % share the AI market could have on the total GDP.

AI will have an immediate impact on the economy (categorized according to eight disparate factors) and lead to an overall impact of more than 1%. However, it is anticipated that by 2030, advancements in AI‘s output and applicability will lead to an overall boost of the economy of approximately 16%, especially with regard to product and service innovation.

Sources: Statista Market Insights; McKinsey

Nearly all markets are currently witnessing a plunge in investments, whereas AI has recently experienced a burst of activity all over the world in many industries

All over the world nations have developed AI strategies to advance their capabilities, through investment, incentives, talent development, and risk management. Most assessments agree that the U.S and China are investing the most, with members of the European Union looking to quickly catch up.

• North America has a National Artificial Intelligence Research and Development Strategic Plan which defines the major research challenges in AI to coordinate and focus federal R&D investments. The National Science Foundation (NSF), in consultation with the White House Office of Science and Technology Policy (OSTP), has established a task force to create a roadmap for a National AI Research Resource (NAIRR)—a shared research infrastructure that would provide AI researchers and students with significantly expanded access to computational resources, high-quality data, educational tools, and user support.

• China has also built a solid foundation to support it's AI economy and made significant contributions to AI on a global level. On research, for example, China produced about one-third of both AI journal papers and AI citations worldwide in 2021. China has a National New Generation AI Plan which involves initiatives and goals for R&D, industrialization, talent development, education and skills acquisition, standard setting and regulations, ethical norms, and security. In the coming decade, there is tremendous opportunity for AI growth in new sectors in China, including some where innovation and R&D spending have traditionally lagged global counterparts like automotive, transportation, logistics or healthcare and life sciences.

• The European Commission wants to transform Europe into a single digital market and declares its wish for a European approach to Artificial Intelligence. The Commission is increasing its annual investments in AI by 70% under the research and innovation program Horizon 2020. The plan is to connect and strengthen AI research centers across Europe, to support the development of an “AI-on-demand platform” that will provide access to relevant AI resources in the EU for all users and to furthermore support the development of AI applications in key sectors.

Investments in AI technologies have surged across various industries, with a notable focus on Natural Language Processing (NLP) in the public sector and computer vision in healthcare. For instance, in the healthcare sector, AI-enabled computer vision technology can be used to assist medical experts in diagnosing diseases and providing better patient care. All sectors mentioned above recognize the potential of AI applications to enhance their operations and services.

The year of efficiency, proclaimed by many AI-focused companies, shows a market rebound led by the tech sector as "old-economy" stocks still struggle

Tech companies were the darlings of the covid economy. However, as in 2022 inflation spiraled upwards around the world, central banks began a cycle of interest rate hikes in an effort to lower prices. The contractionary monetary policy mitigated inflation, but elevated interest rates have also caused various ripple effects throughout the global economy.

This has negatively impacted tech companies, as their share prices have declined in response to the higher cost of capital leading to decreased investments and layoffs. Consequently, tech stocks have plummeted as a result of the economic downturn. Companies have had to tighten their belts, reduce spending, and focus on maintaining profitability, shifting the focus on cash preservation and liquidity, instead of growth.

This viewpoint has altered somewhat in 2023 as a result of advancements in Generative AI, which have the ability to boost productivity and efficiency while lowering costs and creating new growth prospects. At the beginning of 2023 a positive shift has been seen in the tech sector in general and there are more and more signs of relief. Companies are now more open to the idea of leveraging AI technology to optimize their operations. Investment in AI technology has risen significantly and is expected to continue to grow in the coming years. Stocks in "old economy" sectors where AI adoption is not as advanced are therefore still struggling.

• The AI space is a crowded arena, with many key players driving innovation and progress. Some of the top players in the AI space include tech giants such as Google, Meta, NVIDIA or Microsoft, which provides an AI platform that harnesses a set of APIs geared towards using speech, language, and vision at the core of the process.

• As of the 6th of June, the S&P 500 rallies by an impressive 11.31%, primarily driven by gains made by these prominent technology companies fueled by the AI frenzy. The six companies that can be seen on the right side, constitute a combined weight of 26.3% in the index, making them significant contributors to its overall performance.

• A recent analysis by Societe Generale focused on 20 stocks held by AI-related exchange-traded funds, which have seen a 40% growth in assets under management this year. If these stocks were removed from the S&P 500, the index's performance would decline by approximately 10% points, pushing stocks into negative territory for the year. This shows that AI-related stocks have outperformed the overall market this year, and that they have been a key driver of its growth.

• Microsoft expanded it’s partnership with OpenAI, launched Bing AI and Microsoft 365 Copilot, reported 2,500 Azure OpenAI customers, and expects AI to drive cloud growth.

• Alphabet combined DeepMind and Google Brain, launched chatbot Bard, showcased AI-focused search functions, and aims to boost cloud revenues with AI.

• Amazon is investing in Generative AI and LLMs, launched AWS Bedrock for LLMs, and will use AI to drive advertising business growth.

• Meta is focused on AI for R&D and Metaverse topics, monetized content with AI recommendations, and leverages AI for business messaging and making WhatsApp profitable.

• Apple is targeted previously on hardware, expanded services segment, uses AI in products but needs to innovate in order to maintain market advantage.

Sources: Statista Market Insights; CSI Market; Lazyportfolioetf; Macrotrends; Statistisches Bundesamt; R&D World; Company information

MARKET INSIGHTS

Easy access to a broad range of sector forecasts

With 10+ topics featuring 1000+ markets, covering over 190+ countries and regions, discover the future of the market of your choice!

Our Market Insights cover a broad range of topics from consumer goods to technology to automobiles, we provide you with an easy-to-use yet thorough look into the future of every industry with detailed forecasts up to 5 years. For that we cover more than 1000 markets, featuring KPI's like revenue, users, market shares and many more across 190+ geographies. Our insights tool provides you with features like country comparison, currency selection, different visualization possibilities or custom downloads. Access our data via web interface, downloads (xlsx, pdf, pptx), or reports to help with your investment decision, carry out sales planning, support your resource allocation, portfolio management or any other data driven decision.

CONTACT

Get in touch with us. We are happy to help.