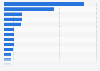

Leading airlines ranked by brand value 2024

In 2024, the most valuable airline brand in the world was Delta Air Lines, with a brand value of roughly 10.8 billion U.S. dollars. The brand value of the second leading company, American Airlines, amounted to approximately 10.2 billion U.S. dollars.

The rulers of the U.S. market

Four of the top five airline brands in the world were American in 2023. Between February 2022 to January 2023, these airlines were as well the leaders in their homeland market. During the same year, American Airlines, headquartered in Forth Worth, Texas, was the leader in the American market, with a domestic market share of 17.5 percent, followed by Delta, Southwest and United.

Turbulent time for the aviation industry

In 2022, commercial airlines worldwide registered operating losses of around 9.3 billion U.S. dollars due to the COVID-19 pandemic, which paralyzed the commercial aviation market around the world. It was estimated that the air traffic will increase in 2023, but the recovery will not get closer to pre-pandemic levels when the number of flights worldwide almost was 40 million.