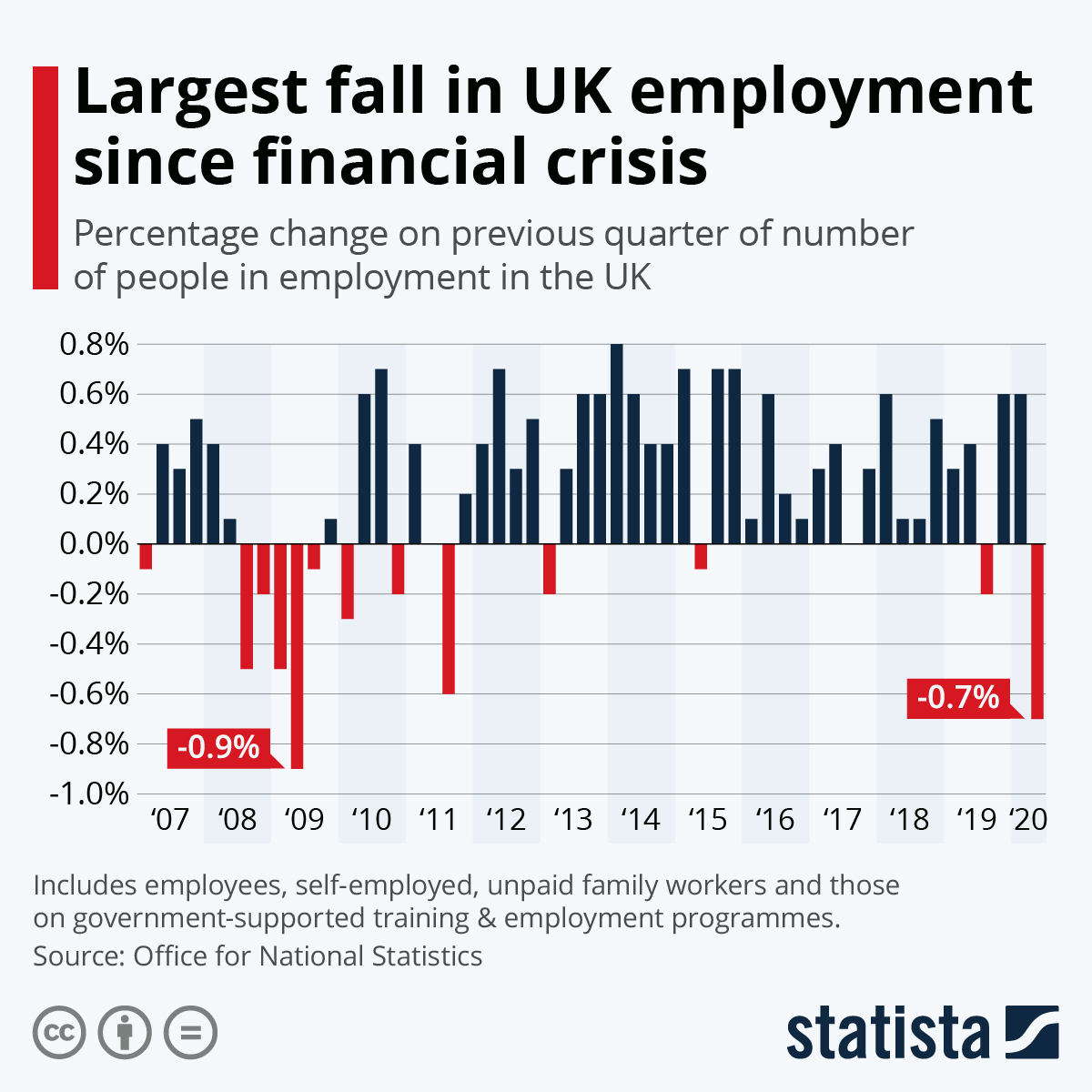

The latest employment figures release from the UK's Office for National Statistics have revealed the largest quarterly fall since the financial crisis - a total drop of 220 thousand people from January-March to April-June. As this infographic shows, that equates to a decrease of 0.7 percent, a figure only surpassed by the second quarter of 2009.

Despite this, unemployment is not rising. As explained by the ONS: "To be unemployed someone has to say that they do not have a job and that they are currently actively seeking and available for work", adding that that due to the impact of the coronavirus: "a group of employees have reported that they are temporarily away from work and not getting paid. Similarly, there are a group of self-employed people who are temporarily away from work but not eligible for the Self-Employment Income Support Scheme".