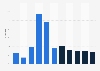

The latest U.S. employment report has struck fear in the hearts of economists (and stock brokers) as weaker-than-expected result saw markets tumble and renewed fears of a recession - also because it triggered the so-called the Sahm Rule indicator, which is based on jobs data, to signal an oncoming downturn. While employment in the country is down by 0.1 percentage points since May and now stands at around 161.3 million people, the smaller group of unemployed Americans grew from 6.8 million to 7.2 million, or from 4.1 to 4.3 percent of the labor force, only since June. Between May and July, monthly nonfarm jobs added in the country decreased by 104,000 to 114,000. Many more new jobs - 176,000 - had been forecast for July.

Consumption indicators in the U.S. meanwhile stayed positive at least between May and June, with real consumer spending, personal income as well as industrial production remaining slightly in the black. For the first two, the July release will not come before the end of the month and could be influenced by July's higher unemployment. However, according to a report by The New York Times, cracks have already started to show with consumers that previously powered the U.S. economy through most of the Covid-19 pandemic and the global inflation crisis after the invasion of Ukraine. Credit card delinquencies are up, while household debt has risen and Americans have used up their pandemic saving, which for some times helped to balance out the unusual type of economic trouble the country experienced during the Covid years. Additionally, earnings calls have mentioned moderation of U.S. demand, for example at Disney and Airbnb. Similar sentiments were recently echoed by representatives of Amazon, McDonald's, Walmart, Big Lots and PepsiCo, according to the article.