Despite growing chatter about the possibility of a “no landing” scenario for the U.S. economy, the International Monetary Fund remains optimistic about major advanced economies sticking a soft landing in the not-too-distant future. In its latest World Economic Outlook, published earlier this week, the IMF expects inflation to return to its long-term average and target level of 2 percent as soon as 2025 in G7 countries, all while maintaining robust albeit comparatively slow economic growth.

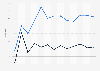

“The global economy remains remarkably resilient,” the IMF wrote in its April 2024 Outlook. “As global inflation descended from its mid-2022 peak, economic activity grew steadily, defying warnings of stagflation and global recession.” Global growth, estimated at 3.2 percent in 2023, is expected to keep a steady pace through 2026, all while global average inflation is forecast to cool gradually from 6.8 percent in 2023 towards its pre-pandemic (2010-2019) average of 3.5 percent, which it is predicted to reach in 2027. The global view can mask stark regional differences, the IMF warns, however, as even within the G7 growth paths diverge significantly. While the U.S. economy has proven stubbornly strong in the face of the Fed’s efforts to tame inflation, European powerhouses France, Germany and the UK are slumping, with Germany even falling into a technical recession last year.

In terms of inflation, the IMF notes that “most indicators” point to a soft landing, while warning that further disinflation could become harder to achieve going forward. “Most of the progress on inflation came from the decline in energy prices and goods inflation below its historical average. The latter has been helped by easing supply-chain frictions, as well as by the decline in Chinese export prices. But services inflation remains high—sometimes stubbornly so—and could derail the disinflation path,” the IMF writes.