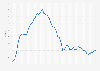

Ahead of this week's meeting of the Federal Open Market Committee, investors were not only waiting for the Fed's interest rate decision, but also hoping for some reassurance with respect to the economy's broader trajectory. The Trump administration's controversial trade policy along with sticky inflation and signs of weakening consumer spending have contributed to a reversal of confidence in the economic outlook, reigniting fears of a recession or a period of stagflation. This has resulted in a sharp market downturn in recent weeks, that saw the S&P 500 briefly slide into correction territory as the tech sector in particular suffered from investors' waning confidence.

So did Fed chairman Jerome Powell and his colleagues succeed in calming the nerves of investors fearing a steeper downturn? At least partly. In his opening statement at a press conference following the two-day meeting, Powell said that the economy was "strong overall", that labor market conditions were solid and that inflation had moved closer to the Fed's two percent goal. He did, however, stress several times that the Fed's outlook was subject to an "unusually high" degree of uncertainty, as the Trump administration is in the process of making "significant policy changes" that could alter the trajectory of the economy. While some could have negative short-term consequences on economic activity or inflation, e.g. tariffs, others, such as deregulation, could have a stimulating effect, for example by boosting private investments. "It is the net effect of these policy changes that will matter for the economy and for the path of monetary policy," Powell said.

Looking at the FOMC's latest economic projections, Fed officials don't see an immediate risk of recession. Compared to their December 2024 projections, they do expect slightly slower growth for 2025 and beyond, however. The median forecast of real GDP in the fourth quarter of 2025 is now 1.7 percent, down from a previous prediction of 2.1 percent and from 2.3 percent actual growth in Q4 2024. In terms of inflation, the committee members revised their previous estimates upwards, now expecting PCE inflation of 2.7 percent instead of 2.5 percent at the end of 2025. All these predictions, Powell emphasized, are subject to "considerable uncertainty", as he called the task of determining the most likely economic scenario going forward "a challenging exercise at this time."