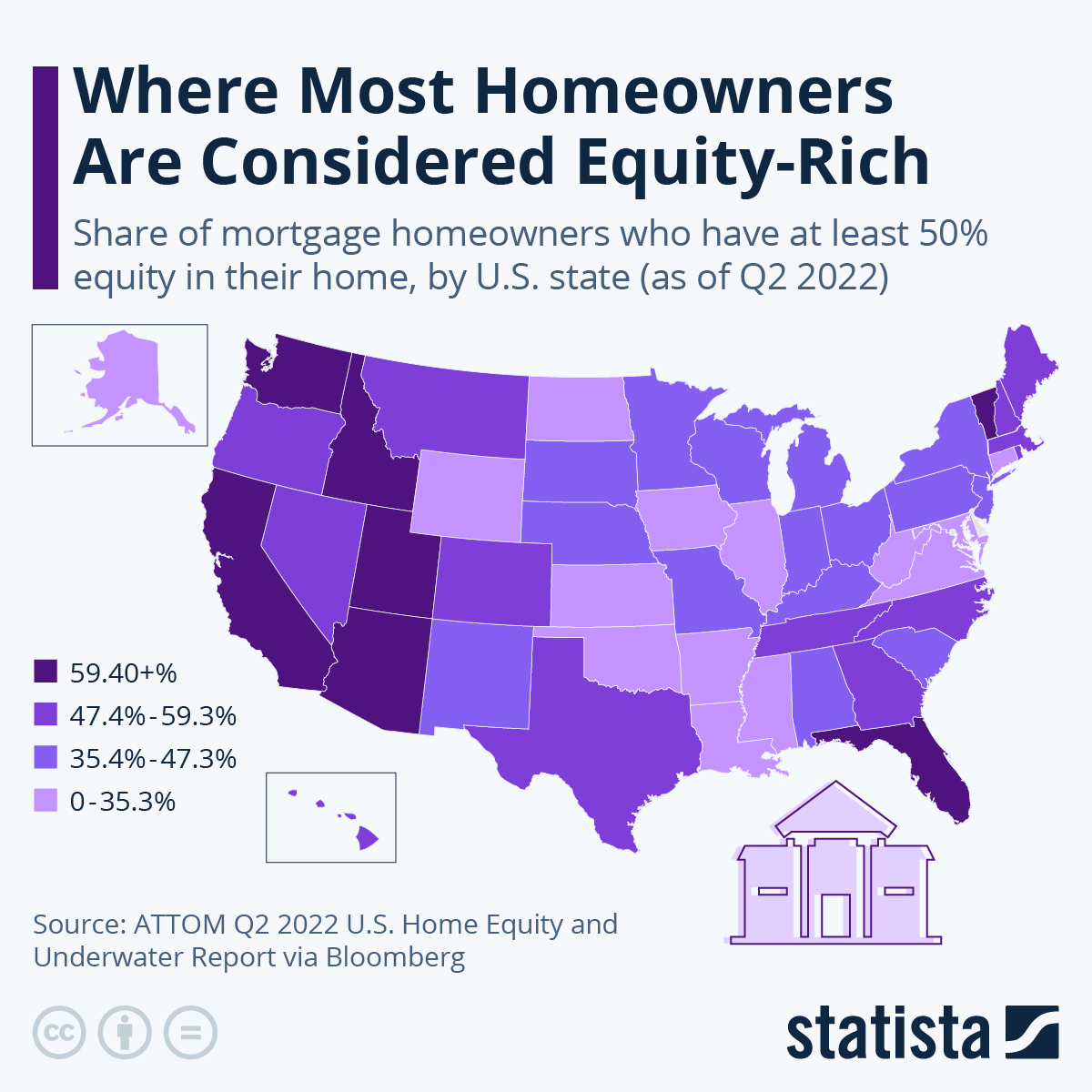

Nearly half of U.S. mortgage payers own at least 50 percent equity, according to ATTOM’s Q2 2022 Home Equity & Underwater Report. This means that the balance of loans taken out against the home is less than half the estimated market value of the property. The share of equity-rich homeowners has been rising continuously for the past nine quarters. While it hit 34.4 percent in Q2 of 2021, it rose to 44.9 percent in Q1 of 2022, and finally to today’s figure of 48.1 percent for Q2 2022.

According to ATTOM, of the 1,624 counties that had at least 2,500 homes with mortgages in Q2 of 2022, 49 of the top 50 equity-rich locations were in the Northeast, South and West. Counties with the highest share of equity-rich properties were Dukes County (Martha's Vineyard), MA (83.2 percent equity-rich); Chittenden County (Burlington), VT (82.3 percent); Gillespie County, TX (west of Austin) (79.4 percent); Nantucket County, MA (78.6 percent) and Travis County (Austin), TX (78.6 percent). Meanwhile, counties with the smallest share of equity-rich homes in Q2 of 2022 included Geary County (Junction City), KS (7 percent equity rich); Vernon Parish, LA (northwest of Lafayette) (9.7 percent); Cumberland County (Fayetteville), NC (12 percent); Acadia Parish, LA (outside Lafayette) (13.2 percent) and Greenup County, KY (14 percent).

At the same time, just 2.9 percent of mortgaged homes were considered “seriously underwater”, meaning that the balance of loans secured by the property exceeded its market value by at least 25 percent. This is down from 3.2 percent in Q1 of this year.

Rick Sharga, executive vice president of market intelligence at Attom, said in a statement: “After 124 consecutive months of home price increases, it's no surprise that the percentage of equity rich homes is the highest we've ever seen, and that the percentage of seriously underwater loans is the lowest. While home price appreciation appears to be slowing down due to higher interest rates on mortgage loans, it seems likely that homeowners will continue to build on the record amount of equity they have for the rest of 2022.”