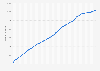

After suffering its first-ever revenue decline in 2022 in the face of growing competition from TikTok and strong economic headwinds, Facebook parent Meta Platforms returned to growth in the first three months of 2023. Driven by a 4-percent increase in advertising revenue, partially offset by a 51-percent drop in Reality Labs revenue, Meta posted overall revenue of $28.6 billion for the first quarter of 2023, up 2.6 percent from the same period a year ago.

Ad impressions across the company's "Family of Apps", i.e. Facebook, Messenger, Instagram and WhatsApp, were up 26 percent year-over-year, while the average price per ad decreased by 17 percent due to strong impression growth in "lower monetizing surfaces and regions", foreign currency depreciation and lower advertising demand.

One of the main challenges faced by Meta is the ongoing transition to short-form video content, or Reels, as a response to the growing popularity of TikTok. And while Reels and the AI-powered recommendations that push them into users' feeds are working - time spent on Instagram is up 24 percent since their introduction in August 2020 - this is actually hurting revenue growth as it is drawing attention away from stories or the news feed, which are more easily monetizable.

The company faced a similar problem after introducing Stories in 2016, but expects the transition to be even more challenging this time. "There are structural supply constraints with the Reels format as people view a Reel for a longer time than a piece of Feed or Stories content, which results in fewer opportunities to serve ads in between posts. That will likely make it more challenging to close the monetization efficiency gap than it was with Stories," Meta's CFO Susan Li said in a call with investors. "Reels is a revenue headwind today that we expect will become revenue neutral by the end of the year, early next year," she added.