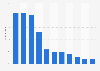

Jet fuel consumption of United Airlines, by segment 2017-2023

In 2023, the jet fuel consumption of United Airlines amounted to over four billion gallons, which represented an increase of around 16 percent in comparison with the aircraft fuel consumption reported a year earlier.