On May 18, 2012, Mark Zuckerberg took Facebook public in what became the biggest initial public offering (IPO) in tech history at the time. At close, 567 million shares had been traded at an average price of $38 per share, topping the record for the biggest first trading day set by General Motors in 2010 by around 120 million shares according to CNN. Now, Zuckerberg's company is called Meta and shares are traded at $200. How do these gains stack up to Meta's Big Tech competitors and which stock has become the most profitable over the last ten years?

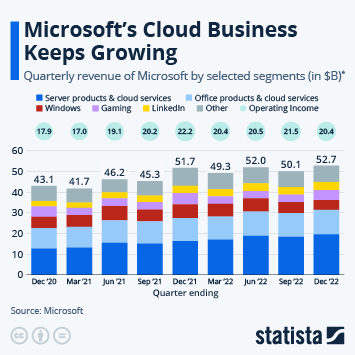

As our chart based on data from Yahoo Finance and Statista calculations shows, investing in Amazon would've paid off the most when comparing the prices from today and ten years ago. Investing $1,000 on May 17, 2012, would have resulted in $10,149 today. Coming in second is Microsoft, which went public in 1986 and would have netted investors $8,798 over the last ten years if they would've bought company shares for $1,000 back then. Meta, on the other hand, sits in last place with only $5,264 generated out of $1,000.

Even though minor fluctuations in tech stock are not unusual, this sector has seen relatively big drops in the past couple of weeks. While share prices for Amazon, Microsoft, Alphabet and Apple started going down at the beginning of April, Meta felt the stock market twinge even earlier. On January 10, the company's share price started its downhill tumble at about $332, now it's worth almost 40 percent less.

Some reasons for this dip in value include investors speculating that GAFAM will be coming down from its pandemic high sooner rather than later and the exorbitant rise in interest rates, which makes investing in safe bonds rather than high-risk stocks more appealing.