While the world was holding its breath, waiting for new information on the latest, possibly more dangerous strain of COVID-19 that was discovered last week, markets reacted nervously on Friday. Stock prices sank and safe haven assets rallied amid fears that the Omicron variant could spark new virus surges and rattle the fragile economic recovery.

Investors betting on a swift recovery of the battered tourism sector were closest to hitting the panic button on Friday, as governments around the world promptly imposed travel restrictions in an effort to contain the spread of what the WHO has classified as a variant of concern. While the travel bans so far mainly affect travel from South Africa, where Omicron was first identified, cases are popping up across the globe, making further travel restrictions likely if the strain turns out to be as dangerous as initially feared.

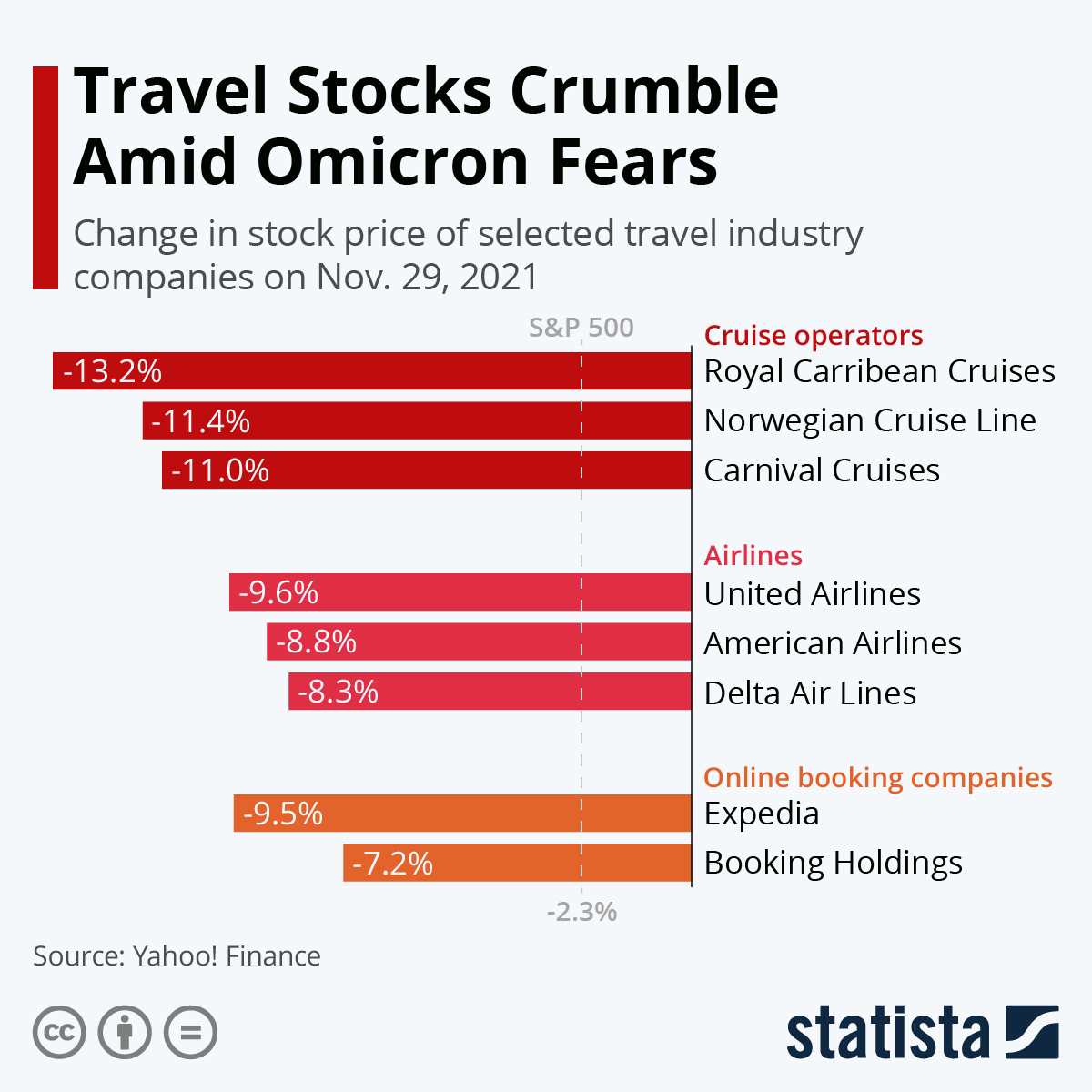

As the following chart shows, cruise lines were once again hit hardest by the sell-off as the three largest operators all suffered double-digit losses on Friday. Airlines and online booking companies also suffered losses that far exceeded the overall downward trend. At the other end of the spectrum vaccine makers Pfizer and Moderna surged, while other “pandemic winners” such as Zoom, Peloton and Netflix also evaded the sell-off.