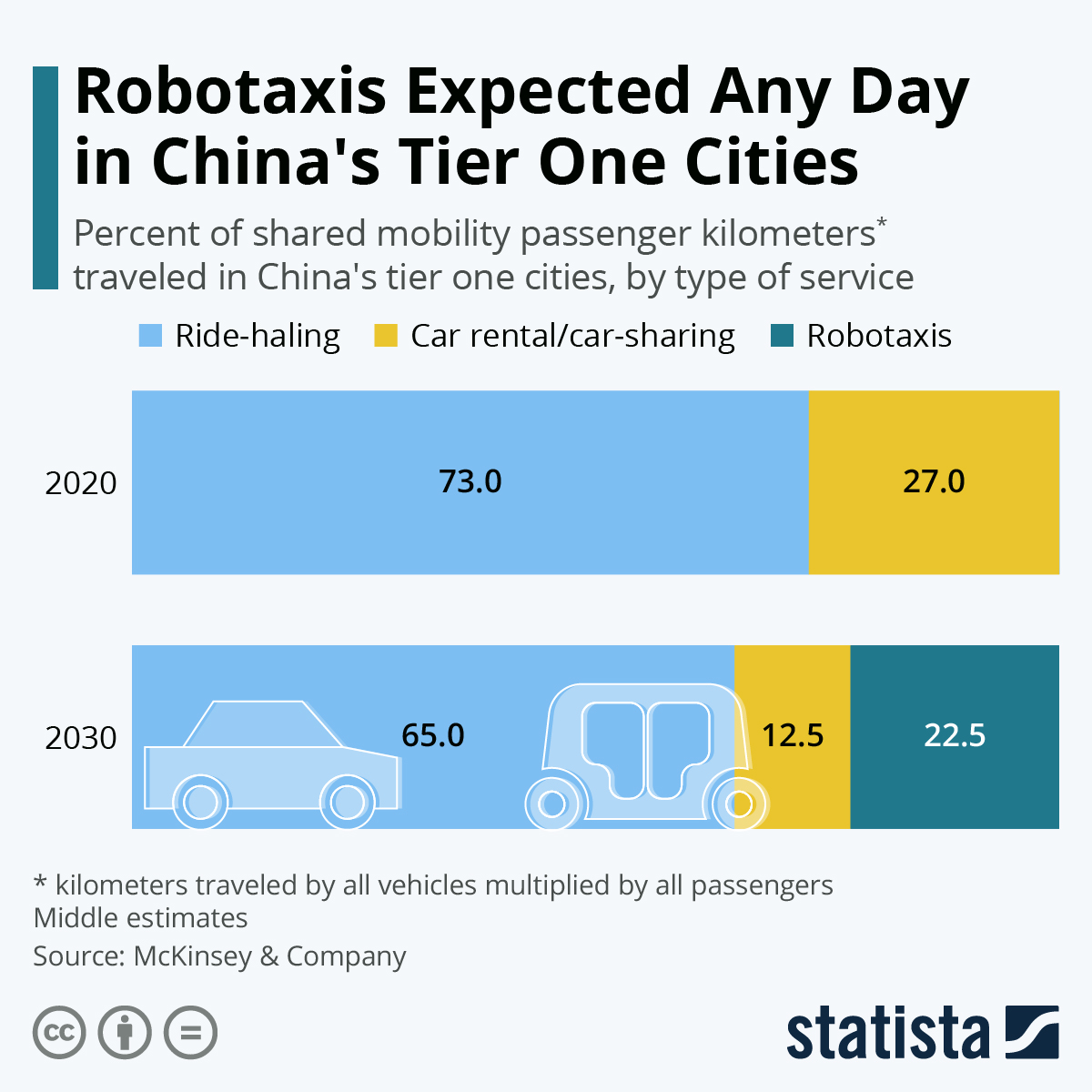

Tests with driverless taxi services have been underway in China's major cities, also called tier one cities, including Beijing and Shanghai. Still a novelty today, robotaxis are expected to experience a quick rollout in China's main metropolises. Numbers by McKinsey & Company show that less than ten years down the line, driverless taxis are projected to service between a fifth and a quarter of all kilometers passengers travel on shared mobility in those cities.

The projected expansion of robotaxis' marketshare will negatively affect both ride-hailing and ride-sharing/car rental. Still, in the growing Chinese market, there is plenty of room as shared mobility passenger kilometers are expected to grow from 177 billion in 2020 to approximately 450 billion by 2030.

Across all of China, robotaxis are expected to hold a market share of around 5 percent of shared mobility kilometers by the same time. Of course, Chinese tech giants want a piece of the new segment, with internet powerhouse Baidu squaring off against ride-hailing giant Didi. Baidu, which builds autonomous cars together with its business partners, has pledged to build 1,000 driverless vehicles in the next three years, while Didi is also rolling out its driverless taxis in a trial phase. Guangzhou, another Chinese tier one city, meanwhile is the testing ground for the robotaxi fleets of startups WeRide, which partners with Nissan, and Pony.ai.