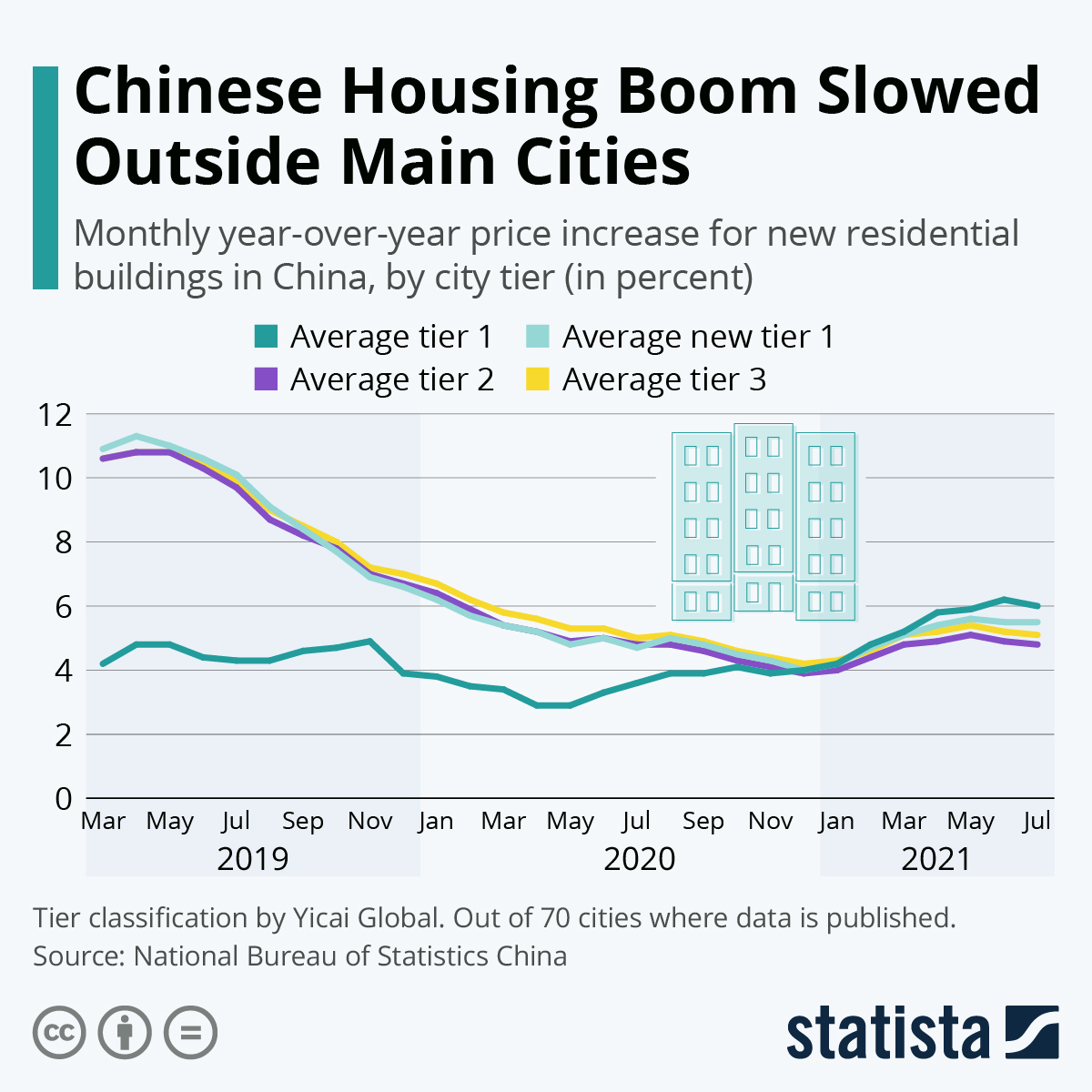

China’s housing Eldorado – where the sales price of new residential buildings rose by 10 percent and more on an annual basis as recently as 2019 - were the country’s new boom towns and lower-tier cities. Data by the National Bureau of Statistics shows that new tier one cities, tier two cities and tier three cities all experienced a significant slowdown of the price of new housing developments in the past two years. The traditional tier one cities, Beijing, Shanghai, Guangzhou and Shenzhen, did not experience the same development. Actually, new housing cost accelerated in China’s four main cities in the same time frame, albeit on a lower level, growing from an average 4 percent in March 2019 to an average 6 percent in July 2021.

According to the Economist, China is building around 15 million new homes every year, causing the construction, housing and homeware sectors to take up an estimated quarter of the country’s GDP. As more and more parts of China are urbanizing, China’s second and third rows of cities saw prices explode even more than its metropolises. During the boom, construction firms as well as buyers have been taking on huge amounts of debt, leading to another striking statistic: One out of every ten dollars in outstanding loans to non-financial clients worldwide is tied to the Chinese property sector.

The gigantic size of the country’s property debt has come into focus once more as regulators have zeroed in on China’s biggest housing developer, Evergrande. A mandated restructuring of the firm – which is $300 billion in debt – might now see investors taking a 75 percent cut. As the developer has been deemed “too big to fail”, the government in Beijing has an interest to ensure that suppliers get paid and buyers have their homes delivered to them, even if investors take a big hit in the process.