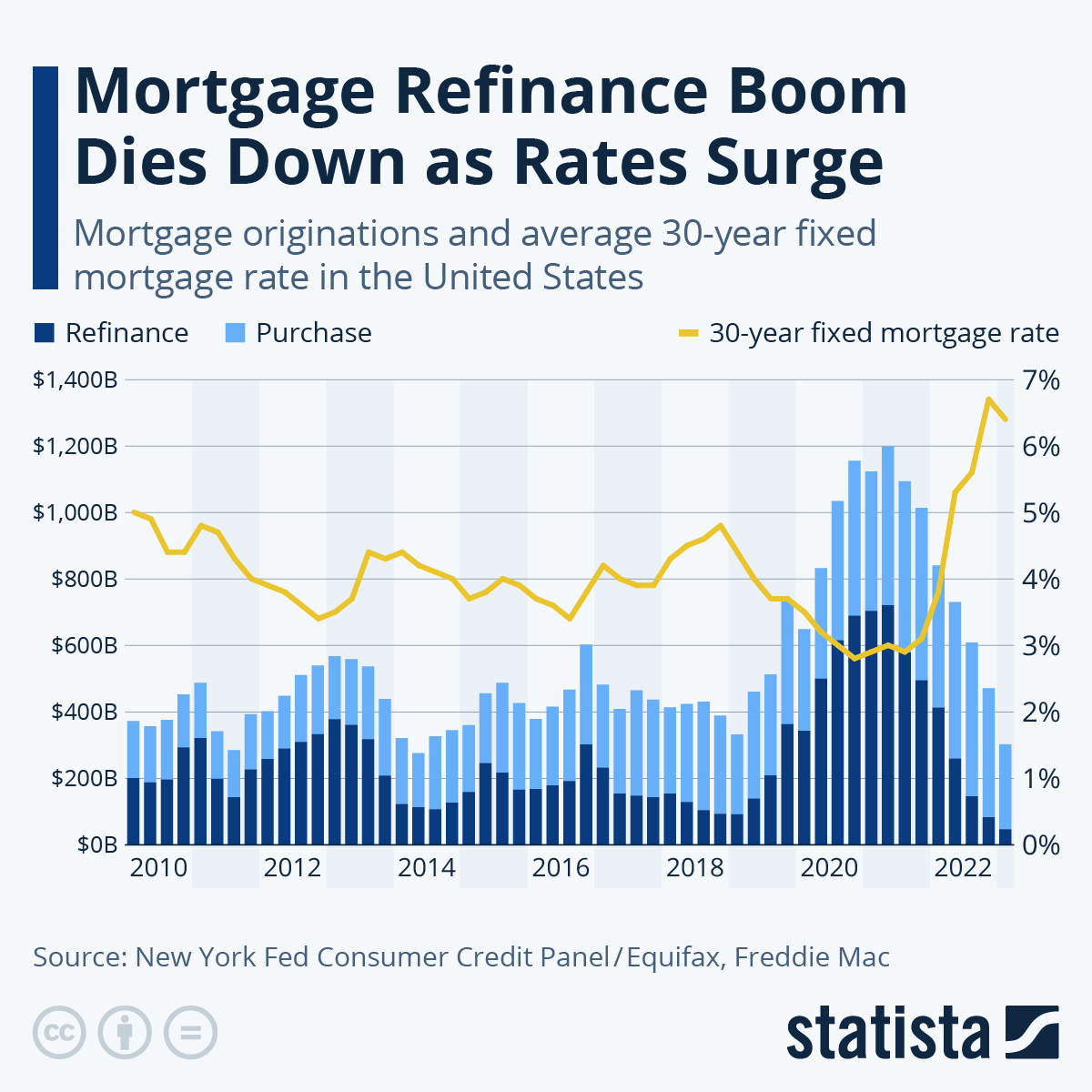

For large parts of the past two years, mortgage refinancing had been booming, as historically low rates and surging home prices created an opportunity for existing homeowners to save a lot of money on their mortgage and, in many cases, even take out some cash in the process. That is no longer the case, however, as mortgage rates have risen by more than four percentage points since early 2021.

According to the New York Fed's Consumer Credit Panel, mortgage originations peaked at $1.2 trillion in Q2 2021, with refinances accounting for 60 percent of that historic total. In total, refinance originations added up to $2.5 trillion in 2021, compared to an annual average of roughly $700 billion between 2015 and 2019. According to Freddie Mac, existing homeowners cashed out $248 billion in home equity in 2021, marking the highest level since 2007.

As mortgage rates started to climb in late 2021, refinance activity began to taper off, before dying down completely in 2023. In the first quarter of 2023, refinancing originations amounted to just $47 billion, down more than 90 percent from Q1 2021. With mortage rates hitting the highest level since 2002 and expected to remain elevated for the time being, refinance volume will likely stay low through at least 2023. Meanwhile the volume of purchase originations has also dropped by almost 40 percent over the past two years, as many prospective buyers can no longer afford a home in today's market.