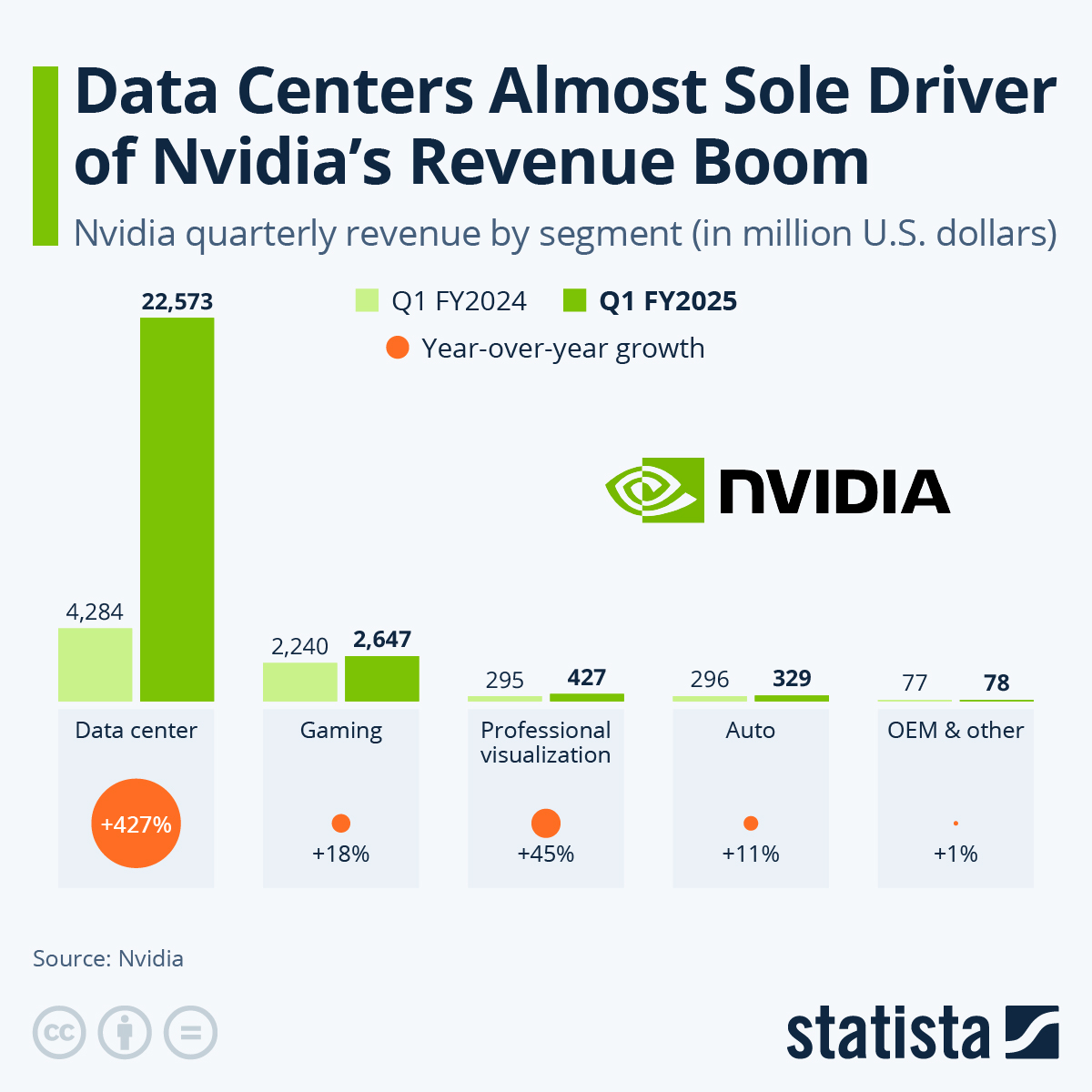

After an already successful fourth quarter of its fiscal year 2024, generating a $12 billion net income on revenues of $22 billion between November 2023 and January 2024, chipmaker Nvidia outperformed expectations yet again, beating analyst projections with revenues of $26 billion and a net income of roughly $15 billion for the quarter. As our chart shows, this immense success would have been considered improbable just a year ago and is largely built on one pillar of the company.

This pillar is the data center segment which includes chips manufactured specifically with the AI industry in mind, which heavily relies on cloud computing and the required resource-intensive, high-powered server farms. Between February and April 2024, $22.6 billion or 87 percent of Nvidia's overall revenue was attributable to data center solutions. Some of its other segments also showed considerable relative growth year over year, with gaming and visualization solutions bringing in 18 and 45 percent more, respectively, than in the company's fiscal Q1 2024. The growth in the data center segment, however, has been off the charts, rising by 427 percent year over year.

This coincides with the AI arms race shifting into overdrive due to OpenAI releasing its newest large language model GPT-4 in March 2023 and demand for dedicated AI chips increasing across the board. "The next industrial revolution has begun — companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center — AI factories — to produce a new commodity: artificial intelligence", said Nvidia CEO Jensen Huang in a press release accompanying the financial results.

Until the advent of the AI boom, Nvidia was primarily known for its graphics processing units (GPU). While still making up the second biggest slice in the chipmaker's revenue pie, this segment only contributed around 10 percent to the revenue generated between February and April 2024. Its biggest contender in this industry is AMD, even though Nvidia's data center success only widened the gulf between the two companies. AMD's gaming revenue was down 48 percent year over year to $922 million, while its data center business grew 80 percent compared to the first quarter of 2023 to $2.3 billion. Overall, AMD made $5.5 billion between January and March 2024.