Japanese multinational Toshiba Corp. is in the news after its CEO Nobuaki Kurumatani resigned today. Kurumatani had been leading buyout talks with global fund CVC Capital Partners, before questions were raised about his role in the talks with his former employer. According to NDTV, two more funds are floating offers for Toshiba, potentially calling into question Kurumatani’s impartiality.

CVC’s plans for the company included turning it private, displeasing shareholders. The Wall Street Journal interprets Kurumatani’s departure as a sign of the power foreign shareholders have started to hold at struggling Japanese companies, which Toshiba is arguably among.

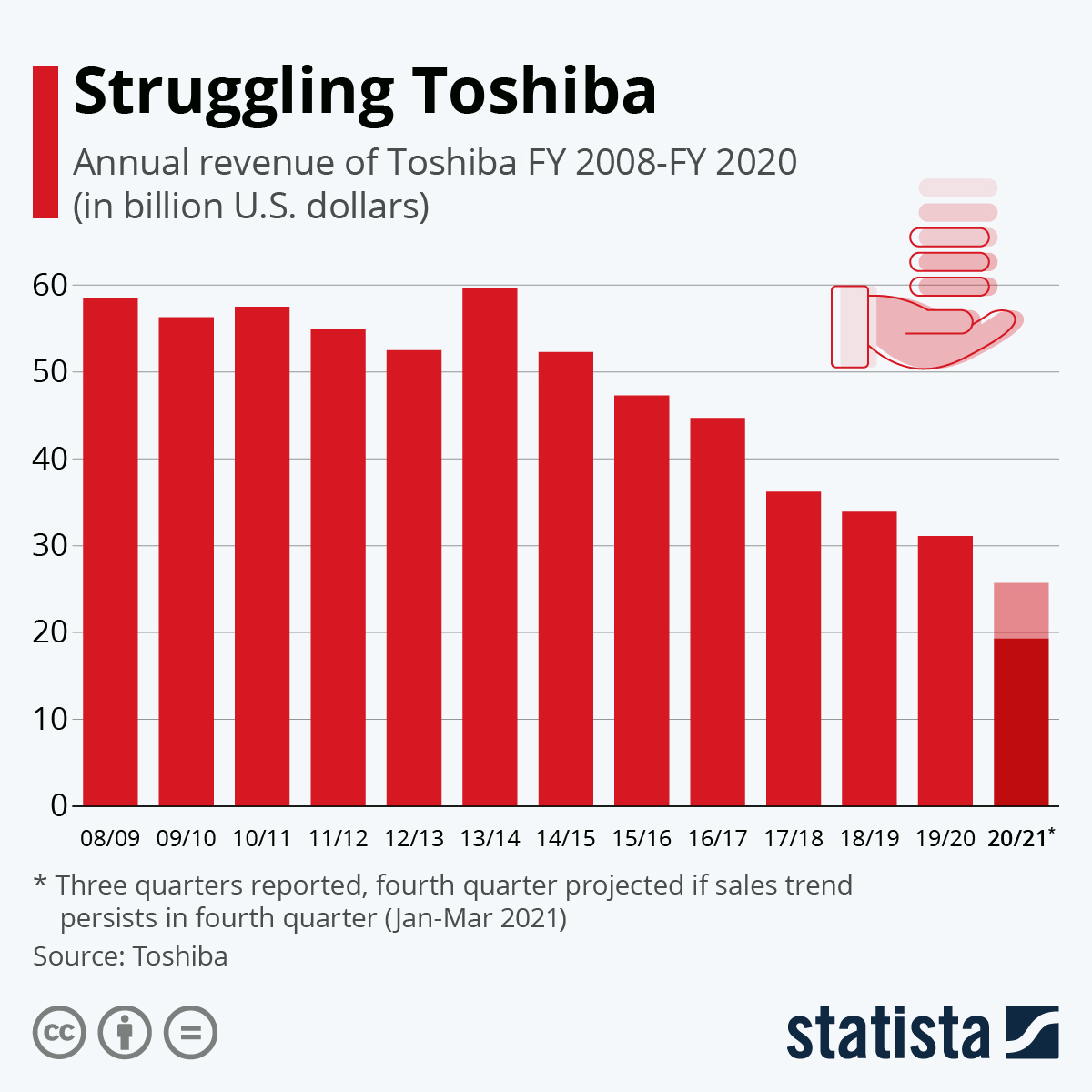

According to financial releases, Toshiba’s revenue has started to dwindle in recent years, decreasing from almost $60 billion in the 2008 fiscal year to just half of that in 2019 and even less expected for 2020. As seen in the data, Toshiba could not benefit from the consumer electronics gold rush of the COVID-19 pandemic, as it (successfully) spun off its semiconductor segment into Kioxia in 2018 and sold most of its laptop business the same year. Sharp acquired the remaining share of around 20 percent in mid-2020, ending the personal computer business for the company that was one of the laptop pioneers of the 1980s.

Outside of consumer tech, Toshiba’s nuclear energy business struggled majorly after the 2011 Fukushima nuclear disaster at Toshiba-owned plant and the 2017 bankruptcy of its U.S. nuclear energy subsidiary. Many nations including Japan are turning away from nuclear energy and Toshiba’s nuclear division has decommissioned nuclear plants, including the one in Fukushima.