Semiconductors built into cars control air conditioning systems, monitor tire pressure, move seats in the interior or ensure that the airbag is triggered in the event of an accident. It is therefore not surprising that microchips have become an indispensable part of modern cars and the automotive industry is growing increasingly hungry for them. With growing digitization, the demand for semiconductors on the part of the automotive industry is continuously increasing, even though 2020 dented it momentarily.

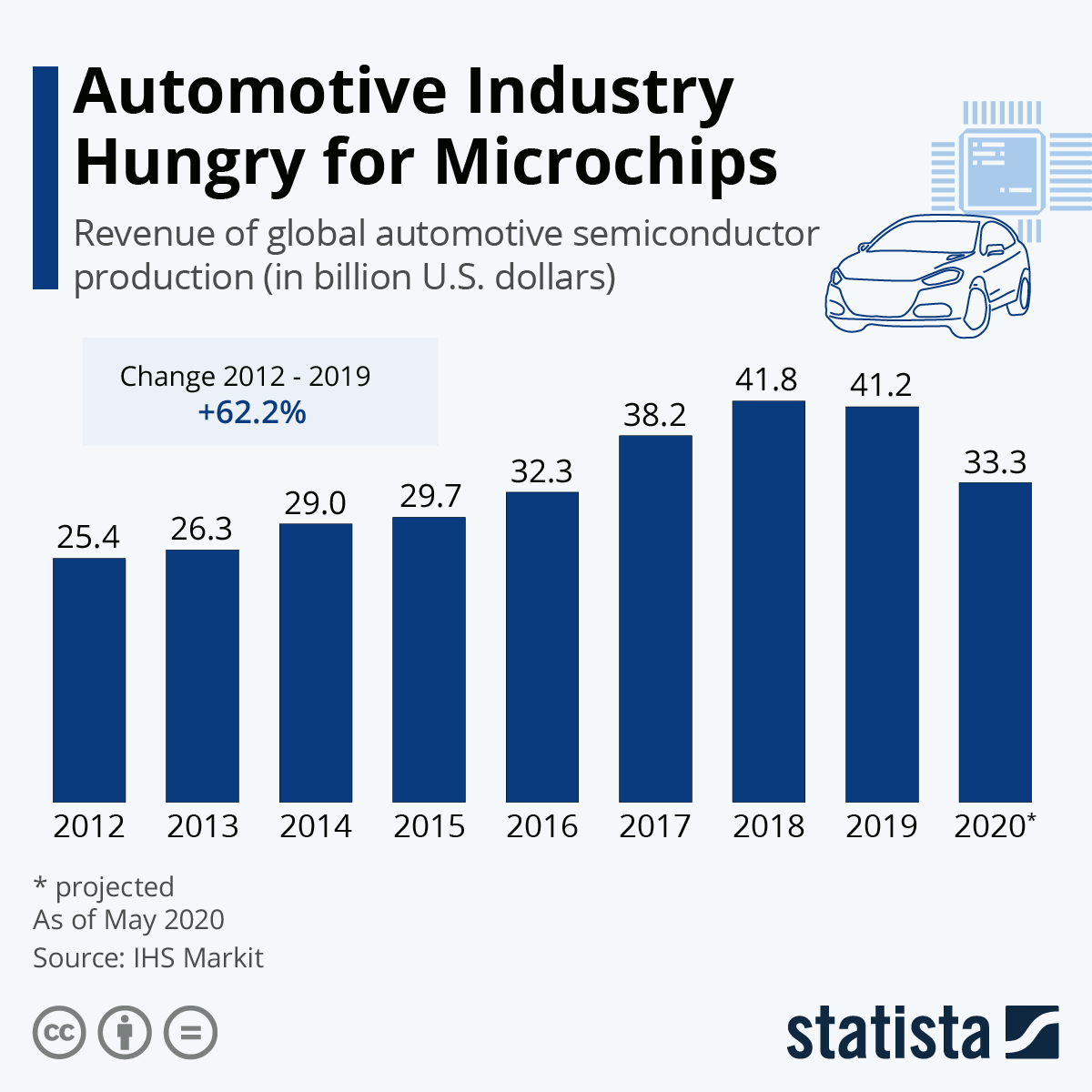

Data from IHS Markit shows that global sales of semiconductor products for the automotive sector rose from $25.4 billion in 2012 to around $41 billion in 2019. For 2020, sales are expected to drop by around $8 billion. On the one hand, this is due to the global corona pandemic. But even if it weren’t for COVID-19, it was doubtful if the demand for microchips in the automotive sector could have been filled to begin with.

The aftermath of a fire at an automotive chip plant in Ibaraki north of Tokyo, Japan, highlights the crunch automotive chip manufacturers are in. The Japanese government is intervening to help repair the damage and bring the plant back online as soon as possible. Japanese automakers are also dispatching workers to the Renesas Electronics Corp. factory to help out. Both microchips and cars are among Japan’s most important industrial products, making chips for automobiles the intersection where an offline plant constitutes a worst-case scenario.

According to market data company World Semiconductor Trade Statistics, total sales in the semiconductor industry will total around $439 billion in 2020. In addition to car manufacturers, smartphone manufacturers are also asking more and more memory chips.