On Wednesday Federal Reserve Chair Jerome Powell warned that the U.S. economy is still “a long way from a full recovery,” as the Federal Open Market Committee pledged to use “its full range of tools to support the U.S. economy in this challenging time”, which first and foremost means keeping interest rates near zero until the labor market has recovered from the COVID-19 shock.

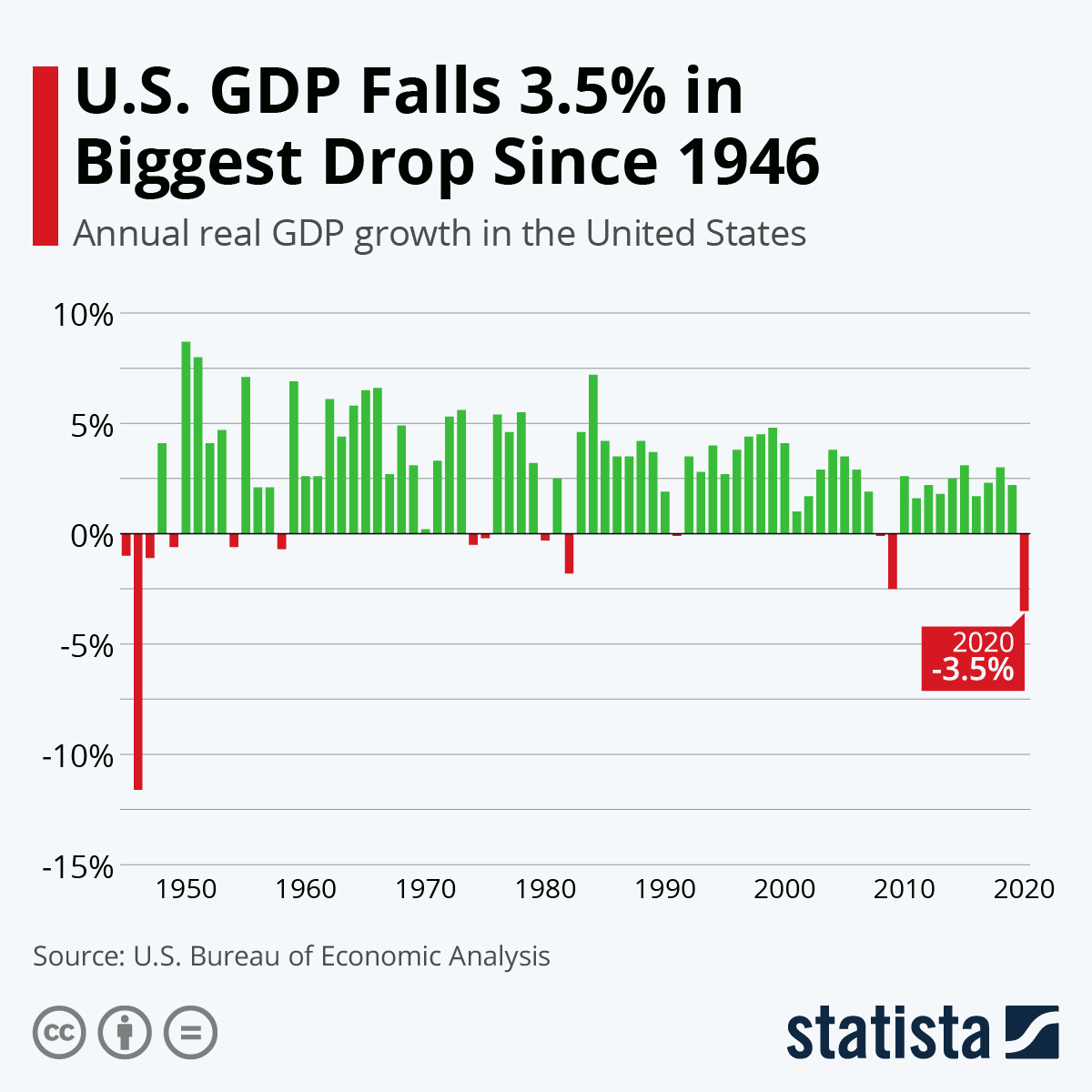

In its statement, the FOMC warned that the pace of recovery had slowed in recent months, with weakness particularly apparent in the sectors hardest hit by the pandemic. The BEA’s latest GDP reading, published on Thursday, supports this assessment, showing that the economic output remained far below pre-pandemic levels in Q4 2020.

Real GDP increased at an annual rate of 4 percent in the fourth quarter, down from 33.4 percent in the third quarter. For the full year, real gross domestic product decreased by 3.5 percent compared to 2019, marking the steepest annual decline since 1946. According to the BEA, the GDP drop was caused by decreases in personal consumption expenditure (driven by a decrease in spending on services), exports and nonresidential fixed investments and partly offset by increases in federal government spending and residential fixed investment.