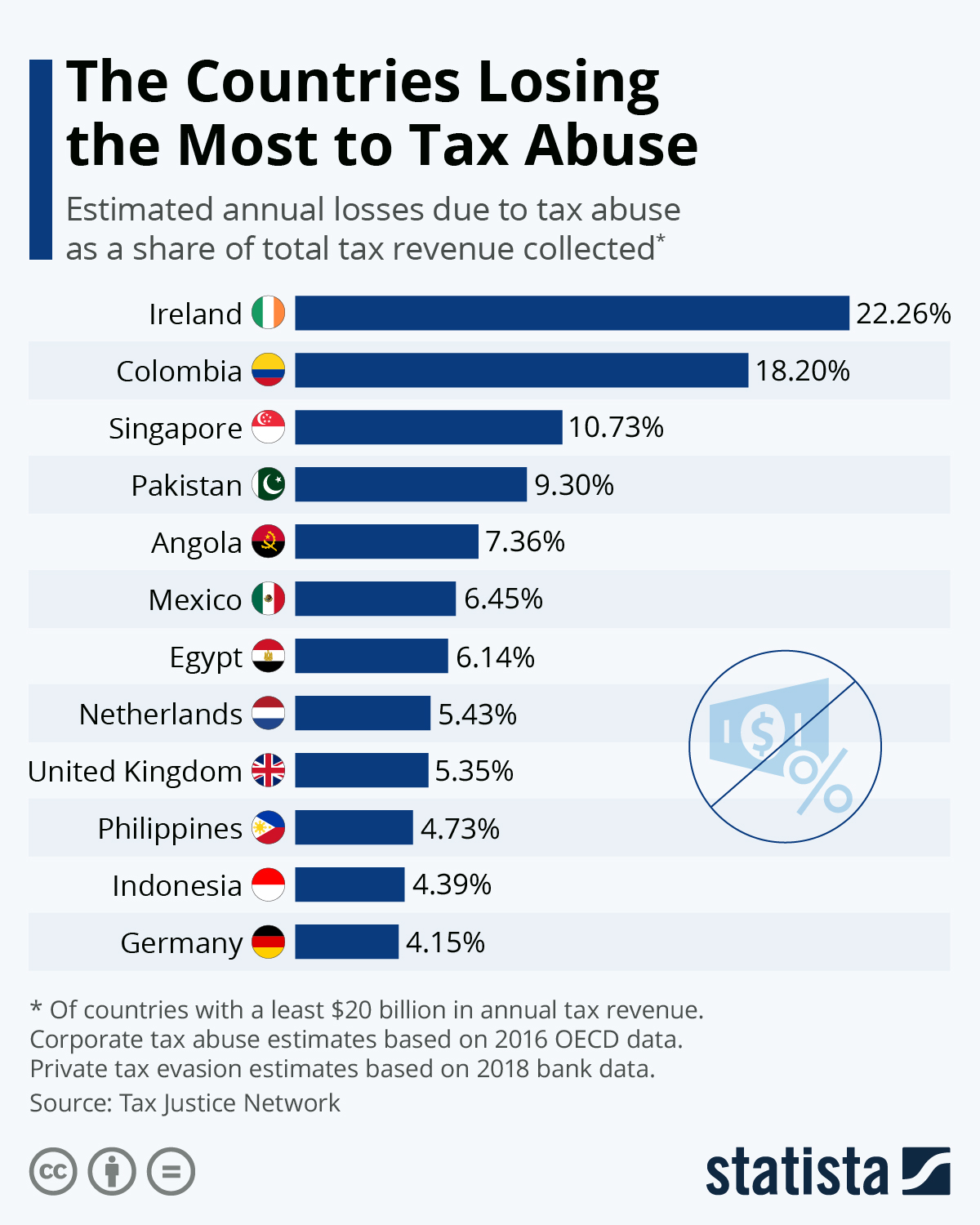

A lot is made of the world's largest tax havens and their role in the global economy, but which countries count among the biggest victims of this tax abuse facilitation? When looking at these losses compared to a country's total tax revenue receipts, Ireland, while also a significant facilitator itself, is impacted to one of the highest degrees in the world. The estimated losses incurred via corporate tax abuse and private tax evasion are equivalent to 22 percent of its total annual tax revenue each year. This chart focuses on countries with annual tax revenues of at least $20 billion.

Overall, high-income countries are responsible for 98 percent of all such tax losses, a finding addressed by Dr Dereje Alemayehu, executive coordinator at the Global Alliance for Tax Justice: “The State of Tax Justice 2020 captures global inequality in soberingly stark numbers. Lower income countries lose more than half what they spend on public health every year to tax havens – that’s enough to cover the annual salaries of nearly 18 million nurses every year."