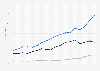

In recent years, the sportswear industry has undergone a significant transformation, as industry-leading brands such as Nike and Adidas discovered the value of direct-to-consumer sales and subsequently pulled away from long-standing partnerships with retailers to push their own sales channels. Nike was at the forefront of that DTC push, growing the percentage of direct-to-consumer sales from just 15 percent in 2010 to 32 percent in 2019. The trend was then further accelerated by the Covid-19 pandemic, when store closures forced brands to lean even heavier into direct sales, mostly via their own digital platforms. By fiscal 2023, Nike Direct accounted for almost 44 percent of the company's Nike brand sales. By that time, the direct-to-consumer euphoria had already worn off, though, as Nike, like other brands, started to realize that strong retail and wholesale partnerships had value as well.

Back in 2021, Nike and Adidas had set lofty goals for their direct-to-consumer channels, aiming for direct sales to represent 60 and 50 percent of their respective sales by 2025 - goals that have long been abandoned as companies are looking for a more balanced approach between direct and wholesale sales channels. Nike's CEO transition is a testament to that new approach, as the outgoing CEO John Donahoe was a key figure in the company's DTC push. Nike's latest results also reflected that new way of thinking, as the DTC share of Nike's 2024 sales didn't grow for the first time in more than a decade. Going forward, Nike plans to "position new products in the path of the consumer and drive more balanced marketplace growth," which sounds like a step back from the direct-first approach of recent years.