After weeks of hearings and Sony and Microsoft making their case for why the latter's planned acquisition of Activision Blizzard King for $68.7 billion should be halted or given the go-ahead, the injunction of the Federal Trade Commission (FTC) was denied a final appeal in court on July 12. If Microsoft can ameliorate the concerns of the UK competition watchdog CMA connected to a potential cloud streaming monopoly, the deal will probably close in the near future. Fans of the Call of Duty franchise in particular have little to fear though: On July 17, Sony and Microsoft signed a binding agreement guaranteeing the release of upcoming titles of the popular shooter series on PlayStation consoles for the next ten years. Even though the acquisition will set a precedent, it's unlikely the video gaming world will see a deal this big anytime soon.

Tencent, for example, held the record for most valuable acquisition for five years after buying an 81.4 percent share of developer Supercell, the firm behind mobile hit Clash of Clans, for $8.6 billion in 2016. But even if Activision Blizzard King might be Microsoft's most recent and most lucrative catch if they can clean up the act of the company, which has come under fire for alleged workplace harassment and toxic office culture, the tech giant has heavily invested in the games space for some time now.

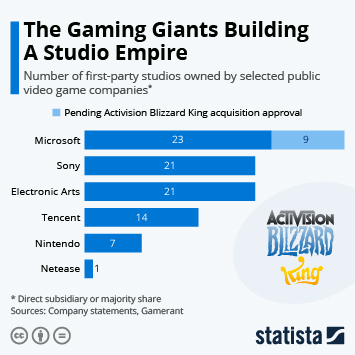

In 2020, it bought ZeniMax Media for $7.5 billion to bolster its roster of internal studios in the lead-up to the release of its current-gen consoles Xbox Series X and Series S. Its acquisition of Minecraft developer Mojang for $2.5 billion in 2014 pays dividends to this day as well, with total game copies sold doubling to 200 million between 2016 and 2020 according to company statements. Interestingly, Sony also heavily invested in other video game studies following the announcement of the deal in January 2022, buying Destiny 2 developer Bungie for $3.6 billion.

Except for deals struck by Tencent, Microsoft, Take-Two, and Activision Blizzard, acquisition prices are usually located in the low billions. According to media reports, only 19 video game company acquisitions or mergers in history had a price tag of more than $1 billion. That those billion-dollar deals often include mobile game developers like Zynga, Supercell, King, Moonton and most recently Scopely, which was bought for $4.9 billion by Savvy Games Group which in turn is wholly owned by Saudi Arabia, is no coincidence. The revenue in the mobile game market was estimated at $92 billion or a market share of 50 percent in 2022 according to Newzoo analysts.