Across the world, some business models have proven resiliant throughout the coronavirus pandemic with online retailers such as Amazon and streaming services like Netflix thriving. A catastrophic health crisis may seem like a good financial opportunity for health insurance companies and according to the most recent results of some major U.S. players, they are raking in billions of extra dollars thanks to the pandemic, with some companies even doubling their profits.

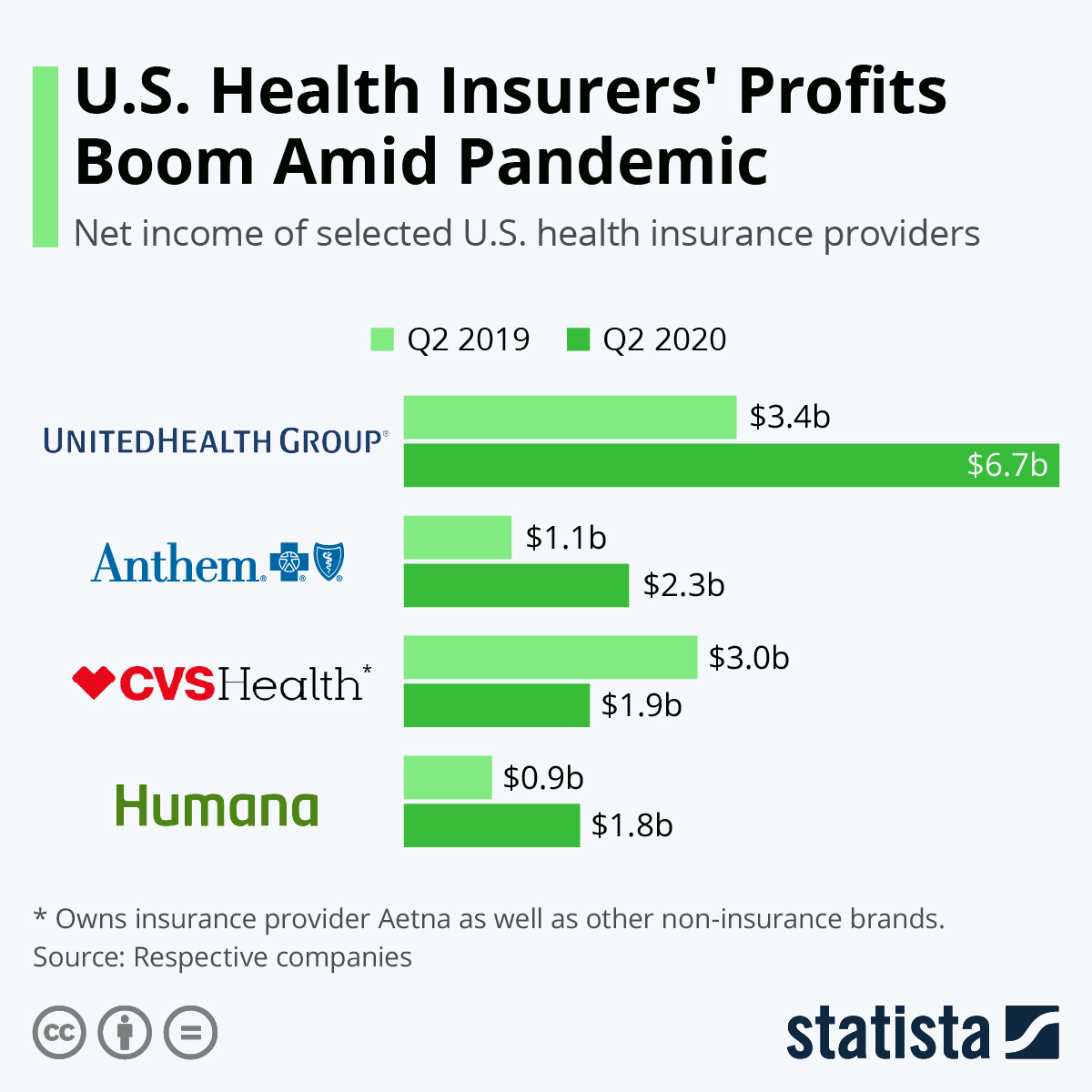

In some parts of the country, hospitals are being overwhelmed by an influx of patients with some announcing staggering financial losses. Meanwhile, major health insurance providers have been able to avoid paying big money for major surgeries and other complex procedures while people have stopped visiting their local doctors in recent weeks. That has led to a drastic increase in net income for most health insurance companies between Q2 of last year and Q2 of 2020 with a selection compared on this infographic.

For example, the UnitedHealth Group doubled its income from $3.4 billion to $6.7 billion with Anthem's also growing by a similar percentage, climbing from $1.1 billion to $2.3 billion. CVS Health owns insurance provider Aetna as well as several other brands including pharmaceutical companies. It added an extra billion dollars in net income in the second quarter of 2020. Humana also posted staggering numbers with a net income of $1.8 billion versus $940 million for Q2 of last year.

The Affordable Care Act saw the profits of health insurance companies capped under the requirement that they pay out rebates for the benefit of their customers, a process which does not seem to be occurring quickly enough given the severity of the current situation. That has prompted the Health and Human Services Department to weigh in on the situation and it has advised health insurance providers to accelerate the rebate process and reduce premiums.