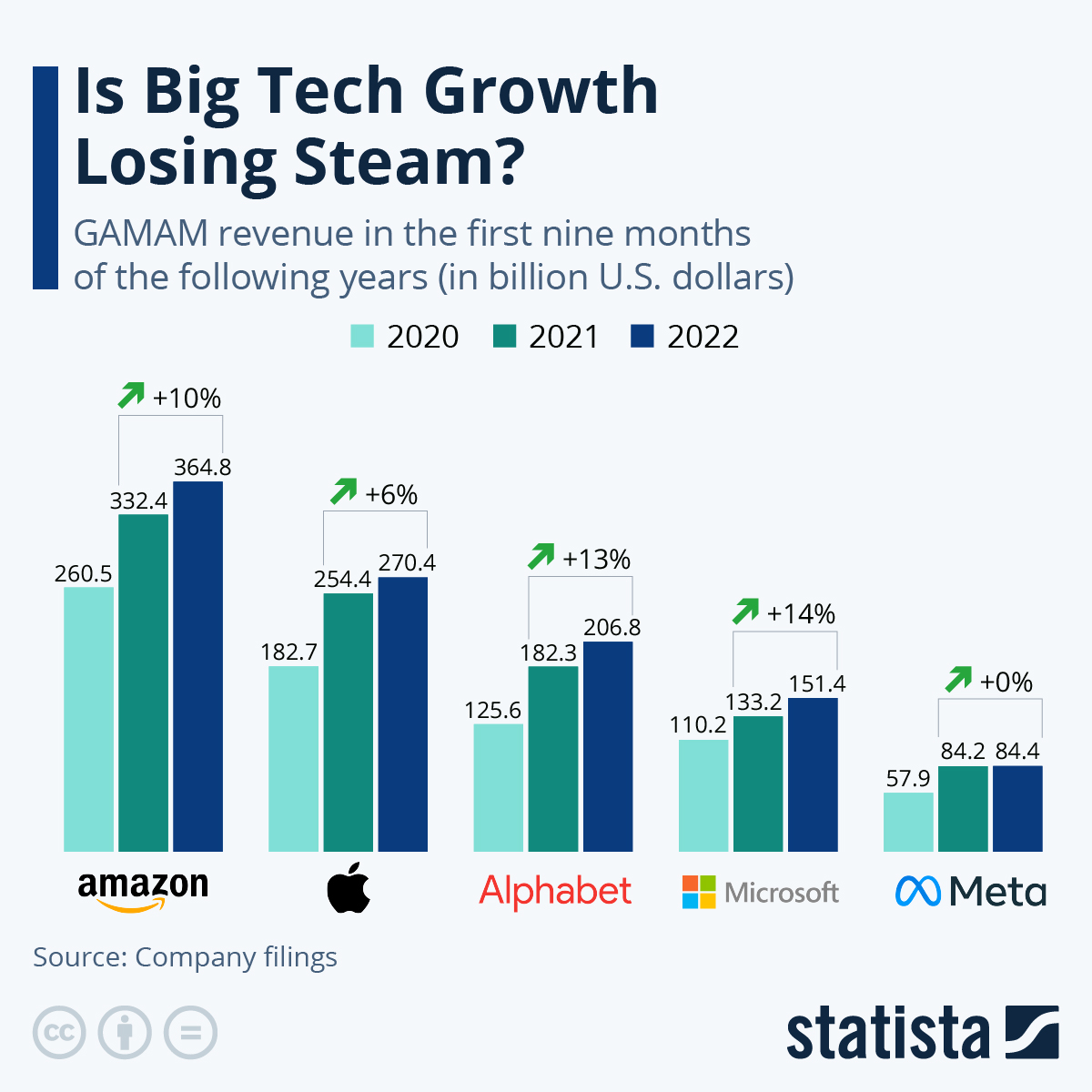

The first two years of the pandemic proved tremendously profitable for big tech companies like Amazon and Meta, with revenue increases between 20 and 45 percent year-over-year when comparing the first nine months of 2020 and 2021. Now, the current geopolitical situation, rising inflation, a looming recession, and China's strict Zero-Covid strategy hampering production in the first half of 2022 have left a dent in the remarkable growth spurt of GAMAM (Google, Amazon, Meta, Apple, Microsoft).

As our chart shows, Meta was hit hardest in revenue growth, with an increase of just $200 million in the first three quarters of 2022 compared to the same period in 2021. This development can be traced back to increased investments in Mark Zuckerberg's metaverse ambitions, which the company will most likely not recoup in the foreseeable future.

Despite releasing new Watch and iPad models in early 2022 and bringing its iPhone 14 product series to market right before the end of its fiscal year, Apple took a similar hit. While revenues grew by 39 percent from 2020 to 2021, this year saw less consumer spending, possibly impacted by the fear of financial constraints due to rising energy and oil prices, and therefore an increase in revenue of just six percent.

Alphabet and Microsoft, on the other hand, fared best in the GAMAM sector with 13 and 14 percent revenue increases, respectively. One key factor in this development is the ongoing demand for robust cloud solutions. Alphabet also saw continuing growth in the Google Search segment, while revenue generated by YouTube ads went down year-over-year.

With growth in the tech sector slowing down, it will likely only be a matter of time before all of GAMAM starts implementing cost-cutting measures like reducing its workforce. After Twitter laid off half of its employees in a bid to turn the social network into a profitable business venture, Meta already followed suit. On November 10, the company announced its dismissal of 11,000 workers, which translates to 13 percent of its global workforce.