The Dow Jones index has seen its worst first quarter in history due to a mixture of coronavirus fears and plummeting oil prices, down 21 percent since the start of the year. Despite a tumultuous start to the year, stockholders are mostly leaving investments untouched and hoping to weather the storm.

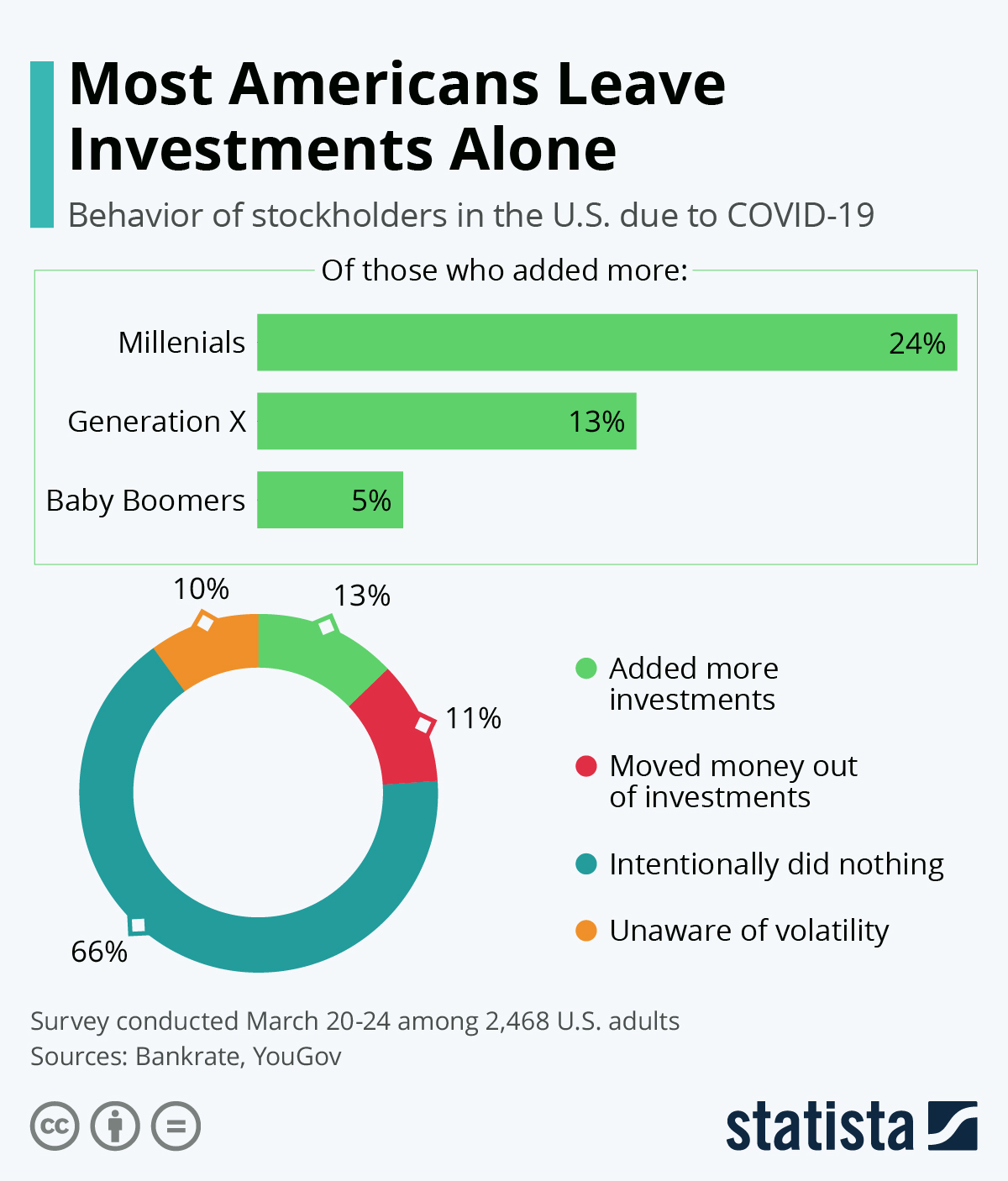

In a joint survey from Bankrate and YouGov, 66 percent of respondents who hold investments said they intentionally left their holdings as is during the first quarter of 2020. 11 percent said they took investments out of the market, while 13 percent added more investments over the last three months. Surprisingly, 10 percent of respondents said they were unaware of the current economic volatility.

Financial advisors are praising stockholders for not panicking during this historic market downswing. Pulling investments en masse can have even more devastating effects on the economy, and history and data point to strong rebounds after large crashes.

Not surprisingly, those in the age range classified as Millennials have been the biggest risk takers during this first quarter of 2020 trading. According to Bankrate, 24 percent of those who added more investments were Millennials, compared to just 13 percent of Generation X’ers and 10 percent of Baby Boomers. Millennials were also the most likely to pull investments at 15 percent, compared to 12 percent and 8 percent of X’ers and Boomers.