Casper Sleep Inc., the company best-known for selling mattresses online, slashed the price range for its upcoming IPO by more than 30 percent on Wednesday, indicating lukewarm demand for what was supposed to be one of the hottest IPOs of 2020 so far.

According to an updated regulatory filing, Casper is now aiming to sell 8.35 million shares for $12 to $13 each, which would cut the company’s valuation in half compared to its latest private funding round, which gave the mattress startup a $1.1 billion price tag in March 2019. Casper originally sought to sell its shares for $17 to $19, which would already have underscored its latest valuation as a private company.

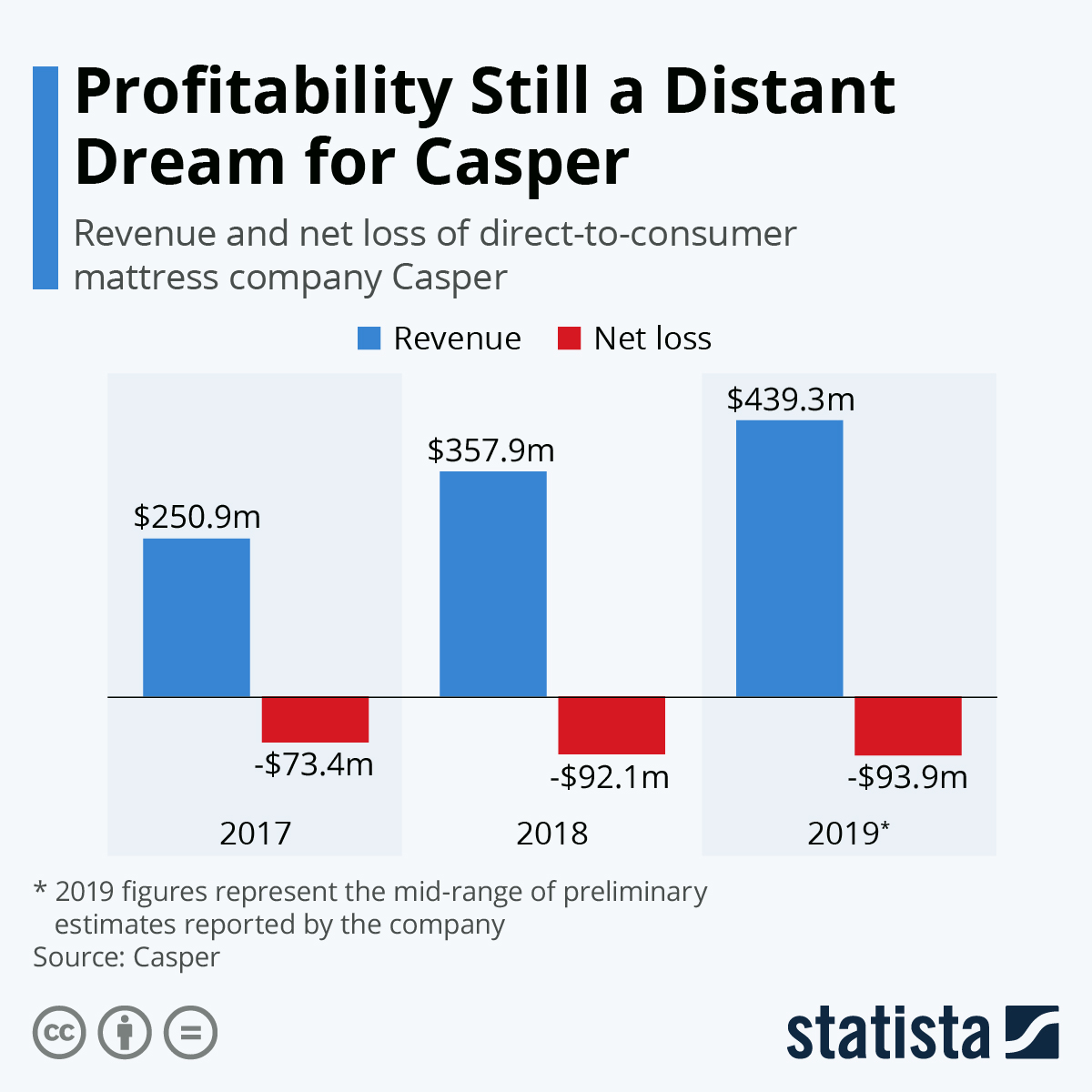

While citing an addressable market of $432 billion in its IPO prospectus, Casper’s current slice of the “global sleep economy” is far less impressive. According to preliminary estimates, the company’s revenue came in between $437.3 and $441.3 million in 2019, up from $357.9 million the year before.

What potential investors might be losing sleep over is Casper’s inability to turn a profit though. The company’s success depends heavily on marketing spending, making the path to profitability look steep and rocky. In the past twelve months, Casper expects to have lost more than $90 million, virtually unchanged from 2018 and up $20 million from its 2017 loss.