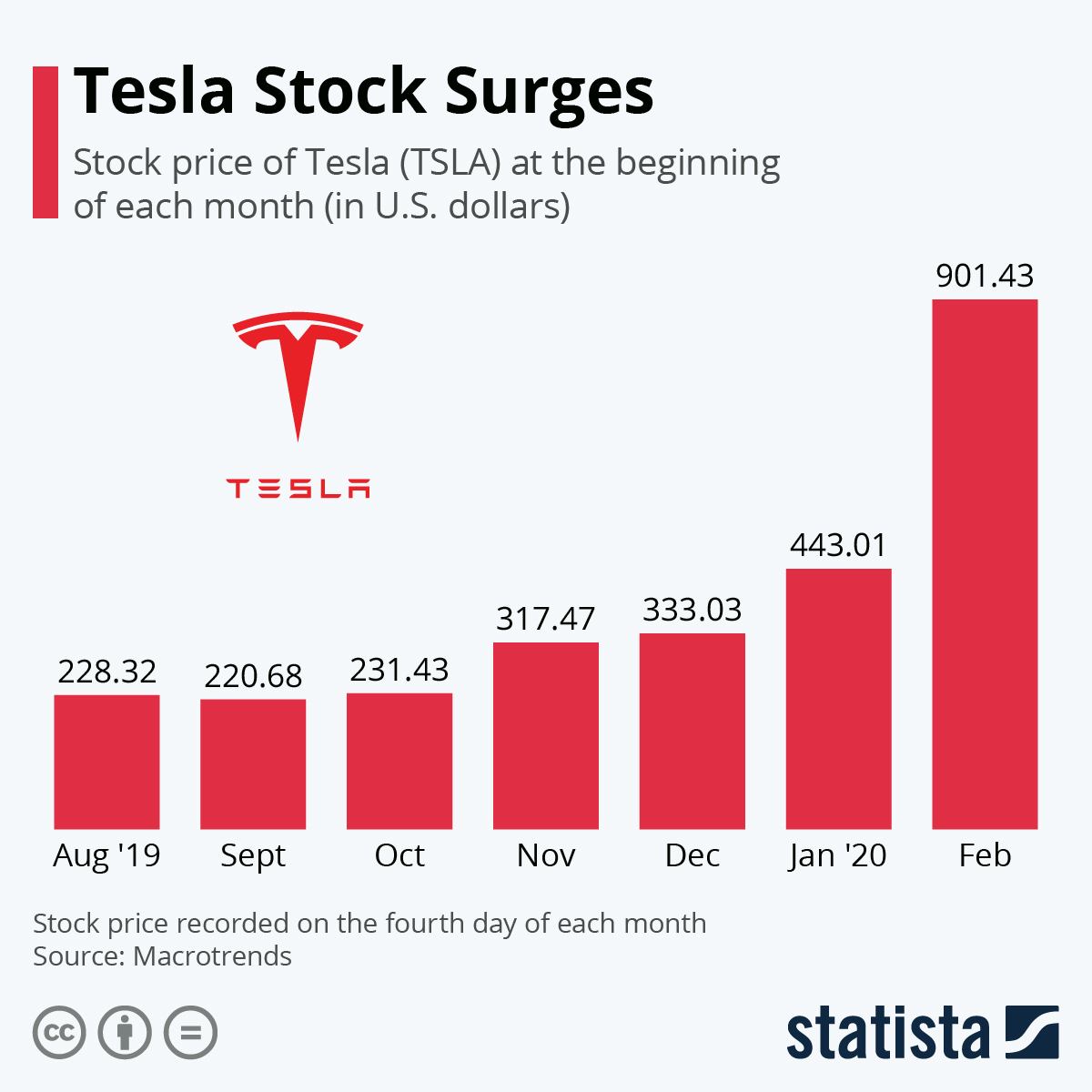

Tesla’s meteoric rise in valuation continued into February, as the electric carmaker’s stock ballooned once again from $650 to over $900 in less than four days.

The car company has been making headlines lately for its rapid growth that’s showing no signs of slowing down. Last week, Tesla became the second most-valued carmaker in the world behind Toyota, and the first-ever U.S. car company above $100 billion in market valuation.

Now, with Tesla’s stock price continuing to outperform expectations, the company is fast approaching Toyota’s $231 billion market cap with a current estimate at $160 billion.

Experts point to a few factors for Tesla’s surge, which include a good fourth quarter earnings report and faster deliveries on the company’s new Model Y car. Others highlight an enormous stock “short squeeze,” where investors who were betting on Tesla’s stock to dip closed their position, further increasing the stock price.

Overall, the Tesla brand is incredibly popular around the world even for those who don’t own or don’t plan on owning a Tesla car, which also partially accounts for Tesla continuing to hold its growth in the stock market. Many still expect the price to fall off a cliff due to unsustainable growth, but nobody knows when (or if) that will happen any time soon.